Summary by Geopolist | Istanbul Center for Geopolitics: The DGAP Policy Brief No. 10 (June 2024) discusses the evolving geopolitical landscape and its implications for Europe. It highlights several key points:

Overall, it calls for a comprehensive strategy that integrates security, economic, technological, and environmental considerations to ensure Europe’s stability and prosperity in a rapidly changing world. The German government should set up a fund of at least EUR 30 billion to finance the most urgent upgrades. The investment should target existing as well as proposed military corridors and be complemented by biennial reports on the condition of all transportation infrastructure. |

| To reduce bureaucracy, Germany should remove paperwork requirements for the transport of military goods between its federal states. On EU level, all member states should focus on harmonizing cross-border movement and custom procedures. |

| Chinese companies should be banned from supplying components for critical communication infrastructure used in transportation. At a minimum, the proposed law on critical infrastructure (KRITIS) should mandate the certification of all critical components. |

Germany is the Linchpin

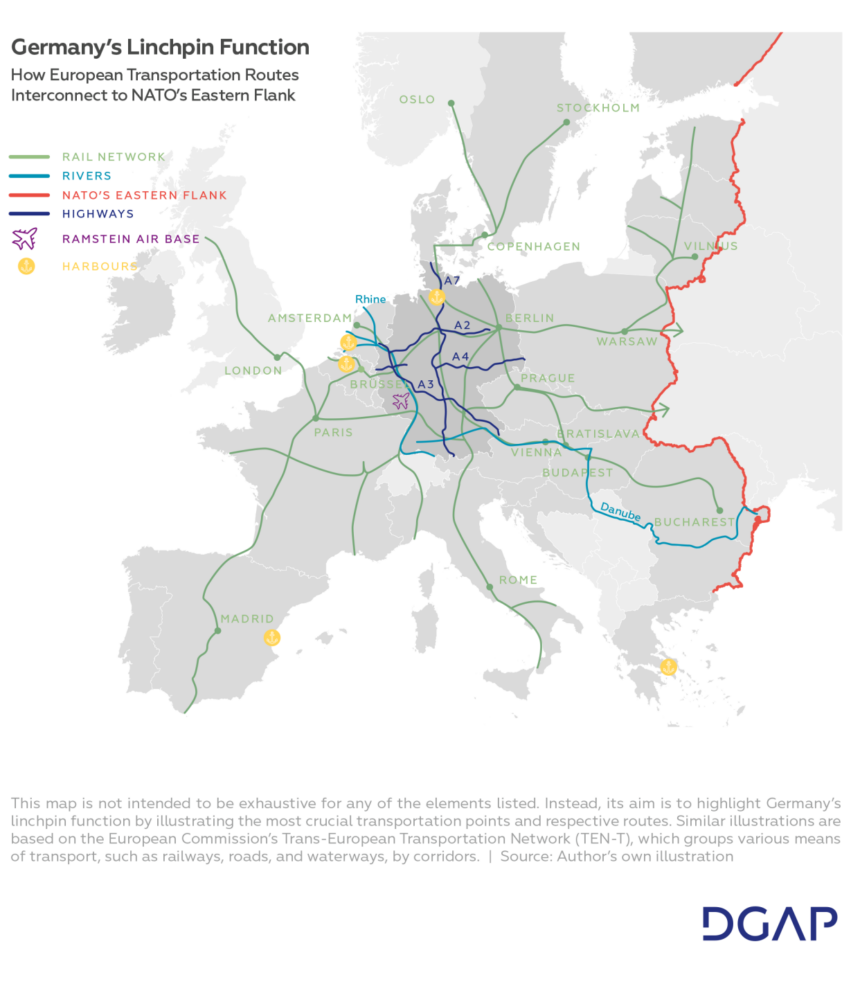

Geographically, Germany holds a crucial position in the heart of Europe, bordering nine countries, seven of which are members of NATO. This makes it the linchpin for moving people, goods, and information across the continent. Its extensive transportation network includes 13,000 kilometers of highway, including numerous east-west connections that are essential to cross-continental movement. Similarly, Germany’s railway system is one of the world’s most extensive with 38,400 kilometers of track. Moreover, waterways such as the Rhine and the Danube are vital for the transportation of heavy goods, linking industrial regions to ports in the Netherlands and Belgium as well as to eastern and southern Europe (see illustration on page 3).

These logistical capabilities are much more than just a backbone for the European economy. They are essential to any defense and deterrence efforts made by Germany and its allies against malign actors. Transportation infrastructure to a significant degree determines how fast Germany and its allies can react in times of crisis.

A New Threat Environment

NATO’s largest and most recent exercise since the Cold War, Steadfast Defender, was a reaction to the changed threat landscape on its eastern flank. Since Russia’s full-scale invasion of Ukraine, the alliance has implemented substantial changes to address the new threat environment. Among others, NATO replaced its Response Force with the so-called New Force Model (NFM). For Germany, this means to be capable by 2025 of deploying 30,000 soldiers as well as 85 ships and fighter jets in the first 30 days of a conflict. Germany also agreed to permanently station a brigade of 4,000 German soldiers in Lithuania from 2025, a move that has become a flagship project of its Zeitenwende. The logistics involved add considerably to the mounting pressure on its transportation capacity.

Steadfast Defender also served as stark reminder to Germany that living up to the pledges of its NFM appears to be in the far distance. This is even more true for the rapid follow-on force that will be needed to aid its Baltic-based soldiers in case of acute threat.

Already in 2017, a commitment to improving military mobility was included in a joint declaration on a common set of proposals issued by the EU and NATO. What followed was an action plan for a “Military Schengen” (to allow for the free movement of military equipment and personnel) backed by proposals to simplify and standardize military transportation procedures under the PESCO (Permanent Structured Co-operation) initiative – a legal framework to jointly plan and invest in common defense capabilities.

So far, however, the results have been disappointing. For the funding of 95 projects, the European Commission proposed a budget of EUR 6.5 billion, which after negotiations with member states was cut down to EUR 1.69 billion in 2017. Given the sense of renewed urgency brought on by the increased Russian threat, the EU announced in January of 2024 that the initial sum of EUR 1.69 billion had been spent and a further EUR 807 million for 38 additional projects would be allocated. However, against the urgent need for serious investments in transportation infrastructure and the sheer number of obstacles, the additional funds will not be much more than a drop in the ocean.

The Costs of (Im)Mobility

During the Cold War, Germany’s military and transportation infrastructure was far better than today. But in 1990, the two German states signed the Two-Plus-Four treaty as a basis for reunification and to reinstate Germany’s sovereignty. In the treaty, Germany committed itself to strengthening “security […] through effective arms control, disarmament and confidence-building measures.”

In practical terms, this meant retiring military equipment, dismantling sirens, and removing yellow tank signs from highways – which led to the loss of important information about the condition and weight capacity of roads and bridges. Moreover, new highways and tunnels were no longer built with military needs in mind. Similarly, Germany’s railway system underwent drastic changes as stock market fitness was given priority over security concerns and people’s needs. In total, Deutsche Bahn’s (DB) privatization efforts in the early 2000s led to reduced investments of less profitable routes and the closure of 5,400 kilometers of track or 16 percent of its entire network.

Currently, roads, rails and bridges are in dire shape, incapable of handling rapid heavy weight transports. In 2022, the scientific advisory board of Federal Ministry of Economic Affairs and Climate Action (BMWK) estimated Germany’s investment backlog for the most urgent infrastructure projects at EUR 165 billion, twice the amount that would have been necessary in 2009. Over the next ten years, according to economic experts, investments of EUR 457 billion – equivalent to an entire annual federal budget – will be needed.

While massive investment is needed, money alone will not solve every issue. The problems with Germany’s transportation infrastructure are compounded by bureaucratic obstacles and the lack of EU-wide standardization as reflected for example by wider rail gauges in the Baltic States. Also, frequent physical attacks as well as cyber-incidents serve as a reminder of the vulnerability of European transportation infrastructure.

The problems besetting the deliveries of military equipment to Ukraine show how dramatic the situation is. Delivering tanks from Spain, France, or the Netherlands to Ukraine means transporting vehicles weighing 65 tons and over across Germany. And just like any other logistics company, the military is faced with the proliferation of rules in Germany’s federal system: Applying for heavy weight permits, finding a stable route through a highway network with dilapidated bridges and tunnels, applying for slots on the overcrowded rail network, and enduring lengthy border controls. In the case of Ukraine, this not only costs extra time and money but endangers the very lives of soldiers and civilians on the front lines.

The Four Bottlenecks

The four primary challenges to Germany’s – and Europe’s – military mobility are: 1) the condition of the transportation infrastructure; 2) bureaucratic obstacles; 3) capacity limitations; and 4) weaknesses in the communication systems.

Fragile Infrastructure

Transportation infrastructure has three primary components: rail, road, and shipping channels. Germany’s railway system is the most important component for military logistics, as it would be the main channel to transport vast amounts of troops and heavy equipment from Bundeswehr bases across the country as well as from allies. The demand on the rail system cannot be compensated by road, water, or air due to the weight and quantity of material to be moved.

The fundamental problems DB faces are not new and have been criticized for years. Recently, DB Tracks, a subsidiary, evaluated the condition of 33,000 kilometers of track including tunnels, bridges, and other key components. The results showed that 23 percent of track are in ‘extremely bad condition’, as are 48 percent of all signaling control centers, 42 percent of level crossings, over 25 percent of railroad switches, and 22 percent of all overhead lines. The consequences are omnipresent, as, on average, every third train in 2022 was delayed.

Compared to other European countries, such as Austria or Switzerland, which have for years employed the same rating system, Germany stacks up way worse. However, those countries have also invested significantly more than Germany. Comparing per capita investments in railway infrastructure, Germany ranked on place 12 out of 15 with an expenditure of EUR 114 in 2022. That is far lower than Austria’s EUR 319 per head and only a quarter of Switzerland’s EUR 450 per capita spending.

In total, investments of EUR 88 billion – a sum close to the size of the special fund Germany set up for its Bundeswehr – will be needed to cover the cost of the most urgent repairs until 2027. EUR 43 billion have already been accounted for in the federal government’s financial planning, leaving additional investment needs of around EUR 45 billion. So far, the federal government only promised to cover an additional EUR 27 billion until 2030, which should specifically be targeted at the renovation of 40 high-performance railway corridors.

In stark contrast, Germany’s road network is given a clear investment priority over the country’s railways. Between 1994 and 2018, 1,700 kilometers of railway line in Germany were built or renewed compared to 247,000 kilometers of road network over the same period. Despite a priority change in the recent years with investment for railways slightly overtaking those for roads, it will take years to compensate the underspending. Yet the condition of the road network is only marginally better, according to the latest transportation investment report by the Federal Ministry of Transport and Digital Infrastructure (BMDV). Moreover, 4,500 of Germany’s 40,000 bridges are in insufficient or deficient condition, incapable of handling heavy vehicles. As a result, military transports are forced into detours of hundreds of kilometers, which add to delays and costs.

Finally, infrastructure in shipping channels also needs investment. Locks and weirs, which help ships to overcome frequent height differences in waterways, are vital components. Yet on average, these systems are 65 years old. One of the most important facilities, the Kiel Canal, even dates back to Germany’s imperial era. Thus, frequent component failure leads to the closure of entire waterway sections, without the option for alternative routes. Germany‘s federal transport ministry estimates the investment needs until 2030 to be EUR 6.5 billion (this also includes the widening and deepening of sea channels).

Bureaucratic Obstacles

In stark contrast to the free movement that EU citizens and goods enjoy within the Schengen area, the mobility of military equipment and personnel in Europe is obstructed by a raft of bureaucratic obstacles within as well as between EU states. This is compounded by a lack of standardization, as each European country has its own set of rules regarding the “special” paperwork required for military transports across its borders.

Germany’s federal structure creates additional obstacles by requiring supplementary forms of approval for crossing borders between the federal states (e.g., from Thuringia to Bavaria). Military transports are often required to move only at night to not disturb regular traffic. Additionally, noise-reduction zones can lead to further detours. Hence, transporting heavy military equipment from Germany’s north to south in 30 days is perceived as “fast.” The regulations would be suspended if the German Bundestag were to declare a state of emergency (see Article 115a GG), though this would likely happen too late to serve any defense and deterrence purposes.

Commenting on military transport on the EU level, Urmas Paet, vice chair of the European Parliament’s Foreign Affairs Committee, said that sending supplies to the Baltic States would currently take “weeks or at least more than a week.” Still, there are also positive examples to draw on. The newly signed agreement between Germany, Poland, and the Netherlands to create a “military transportation corridor” shows how regulatory frameworks can be harmonized. The corridor is supposed to enable more rapid movement of military goods and personnel by cutting red tape and targeting investment at bottlenecks. This agreement should serve as a template for many more such corridors. Ben Hodges, former commander of the United States Army in Europe and military mobility expert, noted that this is a “good start,” even though it was falling far short of the much needed “military Schengen.” In the meantime, transport within Germany remains bureaucratically hamstrung.

Capacity Constraints

The third major hurdle for military mobility is the limits on available transportation capacity. As mentioned, the railway system has a crucial role in the transportation of military equipment, particularly for tanks, infantry fighting vehicles, self-propelled howitzers, and other heavy weapons. Transporting such weapons systems requires time slots for the use of the tracks, locomotives, trailers, loading and transportation equipment, and operating personnel. Flat-bed wagons, which are needed to transport tanks, are in particularly short supply. Since the end of the Cold War, hundreds of flat-bed wagons were retired, reducing their number from over 1,000 in Germany in 1990 to just a few hundred today. Given current capacity levels, it would be impossible to quickly send high numbers of tanks from and through Germany to NATO’s eastern flank. The alliance would need weeks to assemble sufficient heavy capabilities to address an escalating crisis.

In 2023, the Bundeswehr signed a EUR 68 million contract with DB Cargo for the deployment of German military assets as part of the Very High Readiness Joint Task Force (VJTF) under NATO’s pre-2023 force model. The contract specifies key elements of moving military goods and implementing transportation on demand. DB Cargo engaged to reserve a capacity of 343 flat wagons and two daily timeslots for military transportation. Providing additional transport capacity would be difficult in the short term, as equipment and rails are reserved for commercial transports. But while NATO’s NFM requires far greater levels of troops and equipment to be deployed more quickly, the Bundeswehr in 2024 plans to reduce its payments to DB Cargo to EUR 50 million, 18 million less than the year before.

Weaknesses in Communication Systems

Enhancing military mobility has to go hand in hand with safeguarding transportation infrastructure as well as related communications and logistics from both physical and cyber-attacks. An attack on DB’s internal communication system in 2022 should have served as a wake-up call on how easily critical transportation infrastructure can be disrupted. In October of 2022, two cables for DB’s radio system [Global System for Mobile Communications – Rail (GSM-R)] were cut in two separate locations (near Berlin and in the Ruhr area), interrupting both the main and the backup system. As GSM-R is used to communicate vital information between train drivers, network control centers, and dispatchers about obstacles on tracks or dangers at level crossings, the cable sabotage forced a shutdown of all train traffic in northern Germany for several hours. Despite the critical incident, it took DB over nine months to improve security measures at the location where the attack occured. In 2023, Poland also reported attacks on its train radio communication system which forced a sequence of emergency stops.

Rather than addressing the threat of physical attacks on its cable networks, Germany added new vulnerabilities as DB in December 2022 contracted the expansion of its digital infrastructure out to a subsidiary of Deutsche Telekom that buys components could act as a backdoor to tap communication or to cause disruptions. Huawei components have been in use since 2015, and despite warnings, the new contract was awarded in 2022.

Replacing the Huawei components in its infrastructure, as called for by all parties in Germany’s coalition government, could cost the state-owned company up to EUR 400 million. Should DB have to replace the equipment at short notice, the company warned, other railway improvement projects could be delayed by five to six years.

Recommendations

To provide a credible defense and deterrence against aggressors, Germany and its allies must be able to react rapidly in times of crisis. This requires a joint approach on various fronts (i.e., between domestic stakeholders but also between allies on EU and NATO level). Germany, given its role as linchpin for military transports in Europe, has a particular responsibility to improve and enable logistics. The following recommendations address all four bottlenecks identified above.

Fix Transportation Infrastructure

Germany and other EU countries should commission biennual reports to assess the state of transportation infrastructure (roads, bridges, tunnels, rails, and waterways). These assessments should be shared with NATO to create a comprehensive database for military transportation. The report should also include military load classifications for bridges, roads, and tunnels. In Germany, the reports should be commissioned by the federal transport ministry.

The scheduled renovation of 40 high-performance DB corridors between 2024 and 2030 should be reprioritized. Routes that can be used as military corridors should take priority (e.g., renovation of the tracks between Bremen and Osnabrück and between Osnabrück and Münster currently planned for 2030)

Transportation infrastructure in Germany needs a significant financial injection beyond current budget commitments. In the short term, the German government should set up a special fund, detached from its debt break, of at least EUR 30 billion to finance the most urgent upgrades of selected military corridors.

In the medium term, infrastructure investments should be streamlined through investment promotion companies (Investitionsfördergesellschaften, IFGs) as recommended by BMWK´s advisory council. IFGs receive money from the budget and distribute it to the individual states for infrastructure investments only. This system ensures long-term planning security for both municipalities and service providers.

NATO should also consider letting expenditure for projects explicitly aimed at enhancing military mobility count toward allies’ two percent benchmark for defense spending. This would provide members with additional investment incentives, as the public would also directly benefit from the ‘dual use’ nature of these projects.

Reduce Bureaucratic Obstacles

On the national level, Germany should abolish the paperwork required to transport military goods between its federal states. This would significantly reduce response time and ensure that capabilities – including those from allies – can be moved domestically at speed.

On the EU level, all member states should harmonize cross-border permits for military transports across Europe. Countries that are part of NATO but not of the EU should follow suit. Given the threat landscape on NATO’s eastern flank, central and eastern European countries such as the Baltic states, Poland, and the Czech Republic should be under pressure in particular to make amendments.

All EU and NATO member states should implement simplified and standardized customs procedures. Duplication of paperwork should be eliminated, as for instance with NATO’s Form 302 for customs exemption, which so far has to be used in addition to the EU’s Form 302. What is needed instead is either mutual acceptance of paperwork or a joint effort to draw up harmonized forms.

The response time to issue permits for military border crossings should be a maximum of 72 hours – same as NATO’s operational-level planning timeline. Currently, the EU’s timeframe is to respond within five working days, which is much too long given the urgency of such transports.

Address Capacity Issues

In the longer term, the only way to address capacity issues is to invest more into Germany’s ailing transport equipment. Yet there are also some measures that will help mitigate the situation in the short term, as the following examples show:

Germany should focus on securing enough backup locomotives and trailers to increase transportation capacity. Most importantly, it should aim for a reserve capacity of a 1,000 flat-bed wagons available at short notice for military transports.

Military transports on rails and roads should be cleared for transport irrespective of night-time requirements or noise-reduction zones. This would free up additional capacity space for instance for aid deliveries to Ukraine.

Create Resilient Communication Systems

German legislators should reinforce provisions on securing critical infrastructure facilities contained in a draft law currently under debate, the KRITIS-Dachgesetz, which is the national implementation of the EU’s Critical Entities Resilience (CER) Directive. For instance, operators of non-public commercial radio networks – such as DB – could be required to certify critical components and report their installation to the Federal Ministry of the Interior.

5G components from the Chinese providers Huawei and ZTE should be banned from communication infrastructure in Germany and the EU. The ban should not only cover the core network – as currently proposed – but extend to components for access and transport networks such as radio masts. Besides limiting risks of espionage, this would reduce the market power of Huawei in Germany (currently responsible for 59 percent of the 5G network). At the minimum, the timeline for the partial ban, currently set to 2026, should be brought forward to 2025.

The author thanks Lt. Gen. Ben Hodges (ret.) and

Dr. Benjamin Tallis for their expertise.

Source: German Council on Foreign Relations (DGAP)