Summary by Geopolist | Istanbul Center for Geopolitics:

The article analyzes the deepening economic, diplomatic, and military relationship between Russia and China more than two years after Russia’s invasion of Ukraine. Key points include:

- Strengthened Ties: Russia and China have significantly enhanced their partnership, marked by increased economic and military cooperation. This relationship is set to be further solidified by Russian President Vladimir Putin’s upcoming visit to China.

- Economic Relief for Russia: The partnership has partially mitigated the effects of Western sanctions on Russia, particularly those impacting its energy exports. Russia exports oil and natural gas to China and receives cars, machinery, and crucial defense components in return.

- Military Cooperation: The growing military collaboration includes Russia supplying advanced defense technology to China, such as air defense systems and technology for China’s submarines. This cooperation is concerning to the U.S., which views it as bolstering China’s military capabilities and exacerbating global tensions.

- Diplomatic Engagement: Both countries are working to challenge the U.S.-led global order. Chinese President Xi Jinping and Russian Foreign Minister Sergey Lavrov have emphasized their joint efforts to create an alternative global framework. Putin’s visit to China next month underscores the importance of this partnership.

- Economic Adjustments: Russia’s pivot to China is a response to the loss of European markets due to sanctions. While Chinese markets offer some relief, they do not fully replace the benefits Russia derived from Europe. Chinese technology helps with some defense needs but falls short in addressing Russia’s energy sector challenges.

- Financial and Trade Challenges: Despite growing trade, Russia and China face difficulties with financial transactions due to U.S. sanctions and the complexities of moving away from the dollar-based system. The Chinese renminbi has not yet achieved significant internationalization, complicating trade.

- Limited Impact: The intensified relationship between Russia and China does not entirely resolve Russia’s immediate economic problems or China’s long-term challenges. The partnership highlights the limitations of their combined economic and financial influence compared to Western systems.

Overall, while the Russia-China partnership provides some strategic and economic advantages, it also faces significant limitations and challenges, particularly in the broader context of international trade and finance.

For more details, read the full article here below.

Russia and China continue to intensify their economic, diplomatic, and military cooperation more than two years into Moscow’s invasion of Ukraine.

The deepening ties, to be cemented next month by Russian President Vladimir Putin’s visit to China, seem to have given Russia partial relief from the impact of Western sanctions on its economy, which hit energy exports especially hard, and have provided a fillip to acquiring much-needed defense gear. But the growing relationship is a very imperfect solution to the international isolation Russia feels and China fears.

Just weeks before the Kremlin launched its all-out invasion of Ukraine in 2022, Moscow and Beijing formally announced their “no limits” relationship, taking what had been a marriage of convenience and renewing their vows, this time with feeling. Ever since, bilateral trade and military cooperation between the two have exploded.

Trade between Russia and China soared to a record $240 billion last year, and it kept growing in the first quarter of this year. Russia is sending oil and natural gas east, and getting in return cars, machinery, and some critical components to keep its defense industrial base humming. In particular, U.S. officials say, China is providing Russia with drone and missile engines as well as semiconductors that Russia needs for its defense industry. U.S. Secretary of State Antony Blinken last week protested to his Chinese counterpart about Beijing’s role in propping up Moscow’s illegal war in Ukraine.

But the growing military cooperation is not only a concern for the war in Ukraine. It also has implications for a potential U.S.-China conflict.

“What’s even more important is what Russia is having to give away in return” for what it’s getting from China, said Andrea Kendall-Taylor, director of the Transatlantic Security Program at the Center for a New American Security. “Russia is augmenting the military capabilities of China and our other adversaries.”

Moscow, for years leery of providing Beijing with advanced military and aerospace technology, is now opening the vault, providing advanced air defense systems and reportedly some of the advanced technology used in China’s breakthrough new quiet submarines.

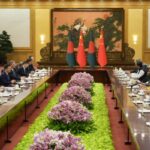

The closer trade and military ties go hand in hand with an invigorated diplomatic outreach. This month, Chinese President Xi Jinping welcomed Russian Foreign Minister Sergey Lavrov, where the two gushed about their creation of an alternative to the U.S.-led global order; Lavrov said enhancing ties with China was Russia’s top foreign-policy priority. When Putin travels to the country next month, it will mark his first foreign trip since his “reelection” in March.

Both countries are at odds with the West, and especially the United States—Russia for its invasion of Ukraine and China for many reasons, not least its threat to take Taiwan by force—so they are seeking a safe harbor.

In many ways, the intensified economic relationship between the two countries is a product of Western pressure. Russia, stung by ratcheted-up Western sanctions after its full-scale invasion, belatedly sought alternative markets to the lucrative one it lost in Europe.

China, which by all accounts is preparing for a possible military solution to its decades-old Taiwan problem, is itself trying to prepare for a world of economic hurt. That is why in recent years Xi has not only looked for self-reliance in high-technology sectors threatened by Western trade restrictions, but has also increasingly warned the Chinese public of the need to brace for “extreme scenarios” if the country becomes an economic and financial pariah due to its own war of choice.

“They are creating an alternative order. Their convergence creates a new center of gravity around which others can gravitate when they are dissatisfied,” said Kendall-Taylor, who previously served as a U.S. intelligence officer. She said that the rejuvenated grouping, despite plenty of historical and modern-day differences, will make it harder for the United States and Europe to rally coalitions of countries to impose costs on aggressor states and enforce global rules.

Yet a Sino-Russian condominium won’t solve either Russia’s immediate problems or China’s long-term challenges.

For Russia, the biggest casualty of the war in Ukraine—besides nearly half a million Russian dead and wounded—is access to the European market for its energy exports, formerly the source of about 40 percent of Russia’s budget. Making lemonade out of the lemons that are the probable loss for good of its biggest and richest market, Russia intensified the pivot to the east that it began the first time it started a war with Ukraine and fell afoul of Western sanctions. Russian oil, largely blocked from the West, has flowed east. Russian gas, unwelcome now in Europe, is seeking a new home in China.

But the Chinese market is not at all a replacement for Russia’s lost markets elsewhere: It is smaller, brings fewer returns, and promises almost none of the advanced energy-sector technology Moscow needs to keep its fields pumping efficiently and its compressors working.

“Asia is very much a consolation prize, and a poor one at that, compared to the loss of Europe,” said Craig Kennedy, an expert on Russia’s energy sector at Harvard University’s Davis Center for Russian and Eurasian Studies.

Russian oil that formerly traded in Europe at only a modest discount to global benchmarks, and which was part of an integrated energy system with Russian gas stations and retail sales, is now scuttling furtively around the seas looking for buyers who demand—and receive—big discounts. Russian oil exports to China have soared, replacing Saudi Arabia as Beijing’s biggest supplier. But it all comes at a discount, and China pockets the profitable bits by refining Russian crude at home.

Ditto with Russian natural gas, which formerly heated Europe but now sits largely untapped in Siberia since Europe quickly swore off Russian gas due to Putin’s latest war. Plans between Russia and China to expand (discounted) gas sales, in the works for years, could amount to an additional 16 billion cubic meters a year—about 10 percent of what Russia formerly exported at a premium to Europe.

And whereas in the past, Russia could count on Europe for advanced technology to goose tired oil fields, tackle challenging frontier projects, and keep its Arctic gas liquefaction plants operational, it now can get almost none of that. Chinese technology can fill Russian gaps in drones, chips, and missiles, but it can’t make old oil fields young again or keep thousand-mile gas pipelines fitted with vital turbines for compression.

“Russia has to pivot, because it has no other choice,” Kennedy said. “But we’re only now beginning to see the full impacts” of the shift of Russia’s energy markets from west to east, he said.

And while the two countries talk up the broader importance of their growing trade ties, touting a near “de-dollarization” of bilateral trade, the reality is a lot messier. Despite years of half-hearted Chinese efforts to internationalize its currency and turn it into something resembling a reserve currency, the renminbi is still between the Canadian dollar and the British pound as far as cross-border trade goes—a distant rival to the U.S. dollar and the euro.

Even Russian firms doing more business with China are relying on expensive middlemen to figure out how to handle payments and transactions in a world where U.S. financial sanctions play whack-a-mole with banks that facilitate illicit trade. In some cases, it’s not just Russian exports that head east: Due to difficulties dealing with international financial sanctions, some Russian firms are decamping smelter and all to China.

Recent U.S. moves to deploy even more sanctions, nominally against Iran but targeting Chinese involvement, are a reminder of the reach of the dollar-denominated global financial system. Even the bottlenecks in Russian bilateral trade with China are reflective of Chinese banks’ unwillingness to risk opprobrium for what is, after all, a tertiary market.

As China prepares its populace and economy to withstand what could be a battery of sanctions and financial isolation in the event of a war in the Pacific, the vaunted closer ties with Russia are actually a reminder of just how little economic and financial pull the new center of gravity really has.

By: Keith Johnson

Source: Foreign Policy