Summary by Geopolist | Istanbul Center for Geopolitics:

China’s domestic situation is evolving amidst several key trends and challenges.

Economic Slowdown

China’s economy has faced significant headwinds, including a real estate market slump, declining consumer confidence, and challenges in its technology sector due to regulatory crackdowns. The growth rate has been slower than expected, raising concerns about long-term economic stability.

Social Tensions

Social issues, such as an aging population and rising unemployment among young people, are becoming more pronounced. The government is grappling with maintaining social stability while addressing these demographic challenges. Additionally, there’s increasing public discontent over strict COVID-19 policies, which have led to protests and a demand for more personal freedoms.

Political Landscape

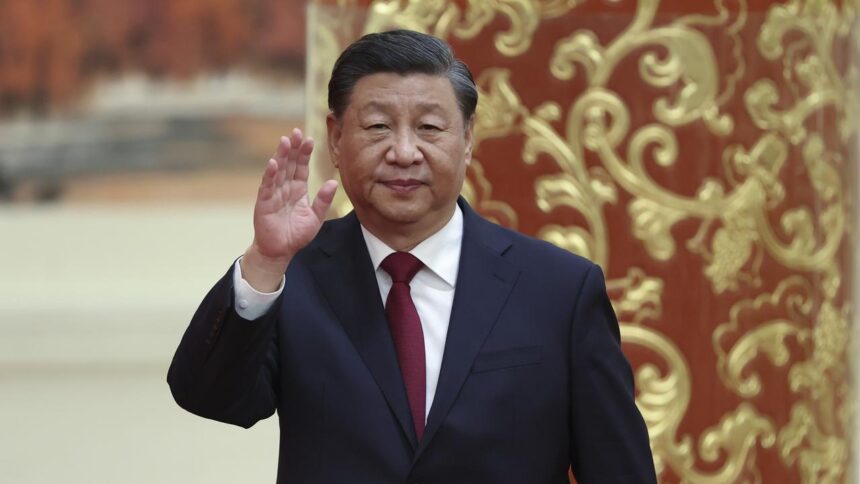

Politically, Xi Jinping has solidified his power, with the recent 20th Party Congress extending his leadership. This consolidation of power has significant implications for China’s domestic and international policies. However, it also raises questions about the flexibility of governance and the potential for policy missteps without sufficient checks and balances.

Technology and Innovation

China is pushing forward with its technological ambitions, aiming to become a global leader in areas like artificial intelligence and renewable energy. However, the tech sector faces challenges from both domestic regulatory pressures and international trade restrictions, particularly from the United States.

Environmental Concerns

Environmental sustainability is a critical issue, with China pledging to peak carbon emissions before 2030 and achieve carbon neutrality by 2060. However, balancing economic growth with environmental goals remains a complex challenge.

Overall, China’s domestic situation is characterized by a mix of economic challenges, social tensions, political consolidation, technological ambitions, and environmental commitments

How is China’s domestic situation evolving?

There is a lot of discussion in Washington about China’s social and economic challenges and the potential implications of these challenges for Chinese society, governance, and foreign policy. In the following collection of short essays, Brookings scholars offer their different perspectives drawing on decades of experience living and working in China to answer the question, “How is China’s domestic situation evolving?”

Diana Fu

China’s gender woes are as pressing as America’s abortion debate

If China’s 1.4 billion population could vote, one of the most pressing domestic issues would be gender and reproductive rights. Just as women across the United States are seething over the denial of reproductive rights in many states, so too, are Chinese women and sexual minorities impassioned about the suppression of gender rights under Xi Jinping’s rule.

Chinese women are not represented in the upper echelons of the Chinese Communist Party, not even for the optics of gender equality. They are encouraged by the party to stay home and become mothers for the sake of solving the country’s demographic crisis. When tennis star Peng Shuai’s public allegations of sexual assault by a former party leader ignited a new wave of the #MeToo movement in 2021, the party clamped down not only on her but also on the millions who supported the cause more broadly. In 2022, a prominent feminist online group called Douban Goose was banned, as were the social media accounts of “Xianzi,” a leading feminist suing a famous state-run television anchor for assault.

The difference between gender politics in America and China is not necessarily in the degree of popular anger. Instead, it may be in the availability and sustainability of channels through which constituents can push for a change in the status quo. American women and LGBTQ+ advocates can and are channeling their fierce objections in courts, on the streets, and in the ballot boxes. These pathways of participation do not guarantee success and are similarly being used by opposition movements to push back against rulings like the recent Supreme Court decision preserving access to the abortion pill. Such is the tug-of-war between parties and movements in the United States.

In China’s authoritarian system, channels for grassroots participation still exist that gender advocates and others continue to fight through and for. Despite a legal system that is controlled by the Chinese Communist Party, activists have continued to file lawsuits that test new regulations on sexual harassment in the workplace. Likewise, women and sexual minorities in and outside of China’s borders have taken to the streets to vote with their feet. Most notably, young women were among the most vociferous leaders of the 2021 protests against China’s zero-COVID lockdowns. In a country where men were the heads of social movements, young Chinese feminists made sure to draw a link between autocracy and patriarchy. Online, radical feminists joined the 6B4T movement, which advocates for a rejection of heterosexual norms and lifestyle. The only important channel of participation that is missing in China is the ballet box itself.

Despite the existence of participatory channels, Chinese gender rights advocates face much higher barriers and risks to pursuing their rights via these pathways. While their American counterparts also face numerous legal challenges and threats, Chinese gender advocates’ struggles are distinctive in that the courts are tethered to the Chinese Communist Party, and protesting is illegal. Even before Xi came to power in 2012, grassroots advocates had to learn to disguise their collective action. Xi is not China’s first anti-feminist leader, nor is he in solo company. Research shows that autocratic leadership is tied to patriarchy and the suppression of gender rights around the world. In this context, the abortion debate that is dominating the U.S. elections is not just a domestic American issue. America’s domestic fights over abortion access, LGBTQ+ rights, and gender equality writ large may well have reverberations around the world.

Ryan Hass

State intervention is sapping economic dynamism

In recent years, China’s leaders have become more directly involved in steering China’s economy in a more techno-nationalist direction. President Xi Jinping and other leaders have extolled the need for China to unleash “new quality productive forces” to climb value chains, promote self-reliance, and stake out comparative advantages in advanced manufacturing. To accomplish this, Chinese economic policymakers are pursuing a strategy that economist Barry Naughton calls “grand steerage”: the use of tools like tax breaks, research and development rebates, state-directed capital allocations, guidance funds, and land and energy subsidies to boost the competitiveness of industries that the Chinese Communist Party leadership deems strategic.

At one level, these policy directives have achieved breakthroughs. China leads the world in a growing array of industries that the country’s leadership has identified as being critical to sustained growth. These include commercial drones, electric vehicles, batteries, shipbuilding, and clean energy. China is currently the largest market for industrial robots, although China’s robotics industry still relies heavily on foreign software. China also has secured major breakthroughs in fielding technologically advanced military capabilities.

This progress is noteworthy, but it is not enough on its own to accelerate growth in an $18 trillion economy. In fact, China’s economic growth is decelerating, following a pattern for virtually all large economies after they have built out infrastructure and neared the technological frontier. China’s real estate sector is in the doldrums, consumption is sagging, and returns on state-led investments are declining. Anecdotally, China’s private sector, particularly its technology sector, lacks the vitality it enjoyed as recently as several years ago. As China’s leaders become more involved in identifying national priorities and China’s regulatory state becomes more capricious in determining whom to favor and whom to punish, corporate risk-taking will be dampened outside of the sectors identified for rapid growth. Increasingly, Chinese technology companies are looking abroad for revenue growth as the domestic economy slows, uncertainties mount, and the local market becomes saturated by competition.

It is not just Chinese companies that are looking abroad for opportunities. So, too, are a growing number of Chinese citizens. China is experiencing the largest outflow of its citizens in decades, a trend that is colloquially described as “runxue,” or the study of how to flee adverse conditions in China by emigrating. This trend is not limited to typical earners, though. China is also experiencing record emigration by high net-worth individuals leaving the country, with over 15,000 such individuals expected to emigrate in 2024; the United States stands out as the top destination.

Waning confidence among China’s entrepreneurial class about the country’s future direction is a trend that bears watching. These individuals—far more than government planners—will determine China’s future level of innovation and dynamism. Ultimately, these are the factors upon which China’s progress will turn.

With a hard-working population of 1.4 billion people, China will continue to grow. How much and how fast the country grows, though, will be influenced by the choices of China’s top leaders. Their current choices are working against the country’s long-term interests. Time will tell whether they prove capable of adjusting course and restoring the dynamism, reform, and opening to the outside world that fueled the country’s historic rise.

Jamie P. Horsley

Under coal’s shadow, China is accelerating its carbon mitigation effort

China, like the United States, is reeling from record extreme temperatures, flooding, and drought. One of the world’s most climate-vulnerable countries, its actions are central to our shared existential climate challenge. China is both the world’s biggest greenhouse gas emitter, responsible for 35% of global climate-damaging carbon dioxide (CO2) emissions, and possibly its greatest hope as a world leader in renewable energies, clean mobility, afforestation, and green finance. Given its extraordinary acceleration of renewable energy capacity in 2023, some analysts predict that China’s emissions may peak in 2024, six years before its declared goals to peak carbon by 2030 and reach carbon neutrality by 2060. Nonetheless, through 2023, solar provided less than 5% and wind just over 10% of China’s actual energy generation, and China still relied on coal—the major source of CO2—for 60% of its energy. Its newly approved coal-fired plants comprised 95% of new coal power construction globally in 2023, justified as security against unreliable renewables under the mantra of “building the new before discarding the old.”

Still, China’s leadership now recognizes that its green, low-carbon transformation is a strategic imperative. It is enacting a flurry of climate mitigation requirements and plans to expand carbon and other greenhouse gas reduction initiatives, better integrate renewables into power grids, and innovate green hydrogen production, complemented by mutually reinforcing climate adaptation efforts such as sponge cities. And, while adding new coal capacity to ensure energy security as demand increases, the government has imposed a new fee on coal power consumers. This fee will compensate coal-fired power plants for maintaining stand-by capacity to meet irregular demand, but constrain excessive coal power utilization, as clean energy output rapidly grows.

China’s emission-reduction initiatives include a nationwide, mandatory CO2 emissions trading system (ETS), informed by global efforts to realize climate change costs through market-based mechanisms, to gradually reduce carbon emissions. Covered emitters trade emission credits based on allowances to emit designated amounts of CO2. Companies emitting less than their allotment sell the difference as credits, while those exceeding their allowance must buy credits to compensate. After a decade of experimentation under regional pilots, China’s national ETS—the world’s largest in terms of covered emissions—launched in 2021. State Council regulations promulgated in January bolstered the ETS institutionally and increased penalties, including for misreporting data. China’s national ETS covers only the power sector, accounting for 40% of China’s carbon emissions, but will expand its ambit this year, with the goal to cover 70% of total carbon emissions by 2030. Regulators will gradually tighten allowances and replace them with paid allotments to further incentivize emission reductions.

The European Union’s ETS, the world’s oldest, helped achieve a 47% reduction in power generation and energy-intensive industrial emissions between 2005-2023. 2022 power sector emissions from northeastern states in the U.S. Regional Greenhouse Gas Initiative fell by 44% compared to a 2006-2008 baseline, faster than the nationwide emissions decline. Although China’s ETS is young and underdeveloped, it has already demonstrated benefits in reducing emissions, conserving energy, and promoting clean energy technical change. Just one of many tools being deployed to address China’s massive climate-related challenges, its adoption and evolution illustrate the dynamism amidst complexity—especially regarding coal—of the country’s decarbonization effort.

Cheng Li and Mallie Prytherch

China’s domestic tourism surge signals a new economic roadmap

Beyond the widely noted stagnation and lack of consumer confidence in the Chinese economy, there is an intriguing and important phenomenon about changing consumer spending patterns and economic choices in China. Despite the reality of overall subdued consumerism, China is witnessing a remarkable surge in domestic tourism, signaling a pronounced shift toward experiential spending, as well as providing insights into market prospects and the dynamics of the socio-economic landscape.

China’s retail sales grew 7.2% year-on-year in 2023, competitive on a global scale but much lower than the double-digit rates of the 2010s. This change underscores an evolving consumer market driven largely by a younger demographic that is increasingly prioritizing experiences over material possessions. Within this sector, domestic tourism is flourishing (See Figure 1).

Chinese economic markers indicate that domestic tourism will rebound to pre-pandemic levels or higher by the end of 2024. The central government has forecasted 6 billion trips this year, and in February, Spring Festival travel was already up 19% from 2019. Additionally, spending per domestic tourist already surpassed pre-pandemic levels last year. Moreover, some reports have shown that those in tourism service are optimistic about the outlook for their sector. And unlike many other sectors, jobs in the tourism industry grew by almost 16% in 2023.

A May 2024 survey found that Chinese travelers are increasingly choosing to travel domestically rather than internationally for several main reasons: the abundance of domestic travel options, the feeling that it is safer to travel domestically, the difficulty of traveling abroad for civil servants and employees of state-owned enterprises, and the high cost of international travel. Additionally, China has a notably fast, clean, safe, and cheap transportation network, making domestic travel significantly easier than international travel.

There are also unique aspects to Chinese domestic tourism. Firstly, Chinese domestic tourists tend to be quite young: those under 35 made up around two-thirds of Spring Festival travelers this year. Secondly, they are traveling not only to major cities such as Beijing and Shanghai, but also to smaller cities and rural areas with cultural significance such as Yangzhou, Luoyang, Qinhuangdao, Guilin, and Zibo. Travelers are highly influenced by media: destinations that “go viral” on Douyin (akin to TikTok) or Xiaohongshu (akin to Instagram) or feature in films and TV shows have seen their tourism numbers surge dramatically.

There is still a relatively low influx of foreign tourists: 40% of pre-pandemic levels as of 2023. The demographics of inbound tourists have also shifted, favoring Southeast Asian countries with visa-free policies. However, China already has well-established infrastructure to attract international tourists, and it is creating policies to make it easier for inbound tourists to navigate the country, making it likely that international tourism will rebound sometime in the future.

From Beijing’s perspective, as China transitions its economy to “high-quality productive forces,” concentrating efforts on tourism will help China refocus on service sector development, which is crucial for China’s overall consumption and economic growth.

Furthermore, while tourism’s impact on Chinese economic growth is far less than property development and foreign trade, the tourism industry can directly contribute to economic growth through revenue generation and indirectly supports a range of other service industries such as hospitality, transportation, retail, and entertainment. Domestic tourism has the potential to hasten China’s transition toward a more sustainable, more domestically integrated, consumption-led economic model, even if it does not significantly increase overall GDP.

Yingyi Ma

The costs of increasing competition in Chinese education

I have been in China throughout June and July, bearing witness to the biggest “gaokao” (college entrance exam) ever, with 13.4 million students registering for the test, exceeding last year’s record of 12.9 million. Gaokao has become a crucible of intense competition and societal pressure for Chinese youth.

Among all the statistics about the biggest gaokao in 2024, one stands out: over 4 million—about one-third of the test-takers—took the test last year. This is a new record of retakers, intensifying the already ruthless competition.

The question is: why does the gaokao have so many retakers this year?

A big advertisement for a high school in a medium Chinese city displays the following: spend one year in our school to retake the gaokao and get into a much better university.

The above reveals why the share of the gaokao retakers is so high. Those retakers are not limited to those who failed the test; many students who initially passed are now choosing to retake the exam, aiming for better scores and entry into more prestigious institutions. Their goal has shifted from simply entering college to securing a place in the best university possible.

This is only one manifestation of increasing competition in China’s education system. Nothing can vividly capture the painful and intractable nature of such competition than the Chinese word “neijuan”— “involution” in English, which has been a buzzword in China since 2017 and refers to the increasing intensity of competition with diminishing returns.

This word “neijuan” (内卷) is used by everyone—literally, everyone I have met in China. From students and parents to corporate elites and street vendors, everyone agrees that the Chinese education system is too competitive and exhausting. Few people know why they use this term, but its popularity must have captured their pervasive sentiments, especially in the education arena. Chinese youth—particularly those in K-12 education, but also including college and even graduate students—are excessively feeling drained by this competition.

What has changed in China’s domestic education system that has spurred so much more competition?

The obsession with elite universities stems from several factors. China’s rapid concentration of resources in key universities, as part of its effort to build world-class institutions, has intensified competition for these coveted spots. Additionally, the expansion of higher education has led to a saturated job market for those with college degrees, increasing employment pressure for college graduates, so it is ever more important to graduate from an elite university to secure a job.

The Chinese government has recognized these issues and implemented measures to address them. Recent efforts include an “academic burden reduction” campaign to crack down on after-school tutoring. However, these attempts to ameliorate “exam-oriented education” may inadvertently benefit students with the means to resort to underground tutoring.

The impact of this educational pressure extends beyond education to family and fertility decisions. Many parents, particularly in the middle class, worry that their children will end up in a lower social status than they themselves had. This anxiety, coupled with the high cost of education, has contributed to declining birth rates.

Margaret M. Pearson

What to expect from China’s “third plenum”

China’s “Third Plenary Session of the 20th Central Committee” is set to occur from July 15-18. This major meeting has not drawn mainstream attention outside of China but is being eagerly awaited in China. Why will it be important? At the plenum, to be attended by all 370 members of the Chinese Communist Party’s Central Committee, China’s leaders will announce major reforms to address the country’s economic problems. Although to many the term “reform” hearkens to pro-market and pro-private sector changes, it seems likely that the reforms will continue to keep state actors in the driver’s seat, reflecting Xi Jinping’s well-established proclivities.

New policies are needed in light of the economy’s continued sluggish performance following an initial post-pandemic bump. This plenum also carries additional political significance. Third plenums are the annual meeting of the Central Committee, normally held in the fall of the third year after the once-in-five-years Party Congress. In the past, these meetings have announced major policy shifts, such as major post-Mao reforms in 1978 and Xi’s bold—but mostly unrealized—market-oriented reforms in 2013. This past autumn, analysts awaited initiatives that might fix the slumping economy. But the meeting did not happen, its absence left unexplained, adding uncertainty and skepticism.

Xi finally promised the plenum in March—oddly enough, during a meeting with visiting U.S. business and academic leaders. State media has stated that the session will focus on “further comprehensively deepening reform and advancing Chinese modernization.” Exactly what it will encompass is not clear. Speculation has ramped up in recent weeks, with broad recommendations floated publicly by eminent economists and former policymakers.

Speculation has fallen into roughly two buckets. The first repeats long-standing proposals frequently voiced by economists, such as reforming the “hukou” system (the system of household registration that regulates internal migration to China’s cities) and further addressing local government debt and the real estate crisis. Familiar also are calls to reassure private businesses, even as measures that amplify state monitoring of private capital continue.

A second bucket focuses on major changes in priorities that reflect Xi’s promotion of “advancing Chinese style modernization,” “economic security,” and “common prosperity” over mere economic growth. Some propose expanding social supports, including financial benefits to incentivize childbearing and more generally to aid the welfare of the masses. Perhaps the most aspirational are measures to further Xi’s vision of rapidly building a technologically advanced “real” economy through the development of “new quality productive forces“ that put China in the vanguard of high-technology manufacturing. This effort, in part directed at overcoming U.S. technology restrictions, reflects Xi’s preference for manufacturing and belief that finance should be a tool for funding other “real” industries, not an end unto itself.

In short, there is no shortage of guesses about what the plenum will prioritize. It is likely that the outcomes will range broadly and be bold in vision but short on detail until implementation documents follow. While the plenum should give officials more confidence to move ahead after a period of uncertainty, a rollout of too many reforms risks overloading the system, potentially diluting the plenum’s positive impact.

Eswar Prasad

Building the foundation for a better growth model

China’s growth over the past two decades was driven by physical capital accumulation—particularly real estate investment, but also substantial investment in manufacturing. However, this approach to growth has created financial risks and engendered inefficiencies. Rebalancing the economy to ensure more sustainable growth will involve reducing reliance on investment-heavy GDP growth, and instead making household consumption the key contributor; generating more from the services sector, rather than low-skill, low-wage manufacturing; and shifting away from capital-intensive growth in ways that boost employment. The COVID-19 pandemic may have halted progress on rebalancing growth, but this now deserves renewed attention from the government.

China’s labor force is shrinking. Investment growth clearly now entails many risks and has become increasingly inefficient; that leaves productivity growth, which is connected to the government’s objectives of fostering domestic innovation, promoting things like electric vehicles and green energy, and moving up the value-added chain. The private sector is likely to play a crucial role in furthering China’s economic transformation. Small- and medium-sized businesses, especially in the services sector, are essential for employment growth—and larger firms are essential for innovation and productivity growth. The government will have to provide adequate support for the private sector if it wants to achieve its economic objectives.

The property sector has been an important driver of growth, contributing about a quarter of the country’s annual GDP. The government’s recent attempts to rein in speculative activity in this sector have triggered price volatility, however, and dampened growth. Capital flight is a real risk if both domestic and foreign investor sentiment turn negative; this could create turbulence in currency markets and set off a capital outflow-currency depreciation spiral that may be difficult to contain. The external environment is therefore likely to remain unfavorable—and China will have to rely more on domestic consumption and innovation to power its growth.

Regardless of concerns about China’s high rate of investment in physical capital, its capital-labor ratio remains much lower than it is in more advanced economies—and China still has vast infrastructure needs to address in its interior provinces. The challenge will be the efficient intermediation of domestic savings into domestic investment, so that capital is allocated to its most productive use. China would benefit from a financial system that does a better job of allocating resources to more productive uses and to relatively dynamic parts of its economy—in particular, the services sector and small- and medium-sized enterprises. This will require fixing the banking system, improving the depth and liquidity of bond markets, and tightening regulation to mitigate risks.

China needs a better institutional framework—one that includes more transparency in its policymaking process, better corporate governance and accounting standards, and more operational independence for the central bank and regulatory authorities to augment financial and market-oriented reforms. These reforms, in tandem with supply-side reforms like restructuring state enterprises, should ultimately help to limit unproductive investment, boost employment and household income, and promote more regionally balanced development. This will be critical for reviving private sector confidence, which in turn could help revive flagging household consumption and private business investment.

Yun Sun

The rise of Global South at the Chinese Foreign Ministry

In 2023, the Chinese government removed two out of its five state councilors. A state councilor is a vice national level (副国级) position on the State Council, ranked between the vice premiers and the ministers. The two dismissed state councilors were at the time Defense Minister Li Shangfu and Foreign Minister Qin Gang.

While Wang Yi, a Politburo member and Qin’s predecessor, has resumed the role of foreign minister since Qin’s removal, this is unlikely to be a long-term solution. Wang is 71 this year, and the current five-year term from 2022 to 2027 is likely to be his last, which means that China must cultivate his successor. The chief of the International Department of the Central Committee, Liu Jianchao, is rumored to be the leading candidate, but no appointment has been made so far.

The long delay in appointing another foreign minister suggests the top leader, Xi Jinping, is taking an extremely cautious approach to this selection. The foreign minister is expected to carry the role of state councilor. The “national leader” ranking of that appointee does not afford Beijing the luxury of another embarrassment after Qin and Li’s removal.

With the pending appointment of a foreign minister, the Ministry of Foreign Affairs (MFA) has reshuffled its leadership in the past two months. One of the striking revelations is that it produced no apparent designated “lead” on North America. Since Vice Minister Xie Feng was appointed ambassador to Washington, the MFA no longer has a vice minister with significant North American expertise. Apparently, there also has been no designated lead on Russia since former Executive Vice Minister Le Yucheng’s removal in 2022 (allegedly as a punishment related to the war in Ukraine).

Below the foreign minister, the MFA currently has nine people in leadership positions. Among these nine leaders, more than half have had experience working in the United Kingdom and European Union, either early on or through mid-career postings. None of the nine has a background (including postings) in the United States or Russia. Excluding the three domestic generalists, two-thirds of the foreign policy leaders have specialties or experiences working in Muslim countries. Two out of three regional vice ministers have a Middle East background, including at least one posting in Africa.

Within the MFA, debate formerly focused on whether the United States or Asia was the central focus of China’s foreign policy. The most reliable indicator is believed to be the foreign minister’s background. When the foreign minister is a former ambassador to the United States, such as Li Zhaoxing or Yang Jiechi, the United States is indisputably the MFA’s top priority. When the foreign minister is a former ambassador to Asian countries, such as Tang Jiaxuan and Wang Yi, Asia is viewed as the priority. Yet regardless of its top priority, the MFA had always had leading officials with specialized experiences in United States and Russia to cover those portfolios.

But now, the MFA’s leadership overwhelmingly skews toward officials with backgrounds in the Global South, to the extent that no specialists on North America and/or Russia are included in its senior leadership positions. From the Foreign Ministry’s leadership composition alone, the rise of the Global South in China’s future priorities is clear.

Susan A. Thornton

Checking in on China’s anti-corruption campaign

In one of his first major moves upon being elevated general secretary of the Chinese Communist Party in 2012, Xi Jinping launched a major anti-corruption campaign. At the time, the effort was billed as vital to restoring public confidence in an increasingly self-dealing party elite and existential to the party’s effective governance and legitimacy. The campaign immediately took down major political heavyweights such as Chongqing Party Secretary Bo Xilai and security minister Zhou Yongkang, as well as other political, security, and military figures, including Ling Jihua, Ma Jian, Xu Caihou, and Guo Boxiong. This proved politically popular, and the campaign continued, even after the departure of Vice President Wang Qishan, who spearheaded the effort as head of the party’s Central Commission for Discipline Inspection (CCDI) under Xi.

Of course, the use of anti-corruption efforts to take out political opponents in China is by no means new; Jiang Zemin similarly sacked Beijing party secretary Chen Xitong in the 1990s and Hu Jintao sacked Shanghai party boss Chen Liangyu in 2006. But the current crusade is much broader; it has not only lasted far longer than these earlier efforts, but it has spawned an enormous, powerful, unaccountable inspectorate under the CCDI and has spread outside the 100 million party members to the private sector and beyond.

What are the impacts of Xi’s anti-corruption effort more than 10 years on? This is a sensitive topic for any government, of course, and it is difficult to find objective information. Interestingly, however, even the Chinese government’s own public pronouncements on its anti-corruption efforts are sobering. Earlier this year, a major meeting of the Central Discipline Inspection Commission deemed the situation “grave and complex.” Although Xi had declared a “smashing victory” over corruption five years ago, at this meeting he said the party must persevere and “win the tough and protracted battle” against corruption.

More probes into dealings by senior-level central officials were launched last year than ever before. The foreign minister, two defense ministers, and nine generals were dismissed and disappeared into the CCDI’s investigative black hole. The CCDI has taken to rolling out an annual documentary series of corruption highlights, including dramatic televised confessions. This year’s cases included high-level corruption in the national soccer federation; a police chief with storerooms full of jade, gold bars, and top-shelf liquor; and a mayor who bankrupted his already underserved city by building lavish resort projects that attracted no visitors.

Many predict this year will see even more investigations. At its annual meeting, the CCDI pledged to step up investigations into sectors “where capital is intensive,” namely “the financial sector, state-owned enterprises, universities, sports, tobacco, medicine, grain purchase and marketing, and statistics.” Amid perpetual inspections and their expanding scope, elites have unsurprisingly grown cynical about, and paralyzed by, these efforts. Officials at all levels have become so tangled up in risk and responsibility avoidance that often little gets done and initiatives languish. The general public must consider why, after a sweeping 10-year crackdown, the eye-popping stories keep revealing more brazen corruption every year. The general impression among an unscientific sample of elites and average people, spurred in part by the publicity around these cases, is that corruption in China is as bad as ever, especially at the higher levels. This perception, as much as the corruption itself, should be a concern for leaders in Beijing.

Source: Brookings