When rockets thundered across Middle Eastern skies in June during the 12‑day ‘war‘ between Israel and Iran, Turkish citizens watched uneasily. The conflict, which saw Israel rely on air‑force dominance and Iran answer with salvoes of ballistic and cruise missiles, underscored how much modern warfare hinges on advanced technology. In cafes and on social media, many Turks wondered whether their own country could withstand a barrage of hypersonic missiles and drones — and if Ankara was prioritizing the right military capabilities.

Reflecting this public mindset, President Recep Tayyip Erdoğan said in mid‑June that Turkey is “making production plans to bring our stocks of medium‑ and long‑range missiles to a deterrent level in light of recent developments,” a reference to the 12‑day conflict between Iran and Israel, during which ballistic and cruise missiles were used extensively. His remark underscores the government’s focus on strengthening missile stockpiles.

Turkey’s defence boom is often associated with the debut of sleek weapons at fairs like IDEF 2025, yet a quieter transformation has been unfolding behind the scenes. As the country’s once‑buoyant construction and real‑estate industry cooled and the broader economy slowed, major contractors and engineers sought new avenues for growth. A political economy study notes that during the past decade, the defence sector emerged as a “profitable area of accumulation,” drawing capital and expertise away from housing and infrastructure projects and spreading downwards in a pattern similar to the construction industry. The military industry now stands alongside infrastructure construction and energy as one of the main sectors shaping both the government and the state, and that many new defence firms resemble the construction companies founded by engineers who left the public sector in the mid‑twentieth century. Builders who once erected highways and apartment blocks are now designing drones, armour plating and hypersonic missiles.

From construction sites to defence factories

Turkey’s economy has long relied on large construction projects, with domestic contractors building airports, bridges and apartment complexes across the country and abroad. When growth slowed in the late 2010s and early 2020s, however, the profit margins of real‑estate development narrowed. At the same time, sustained government investment and export incentives turned the defence sector into an attractive destination for capital. The big companies followed government guidance and migrated into arms production as public tenders multiplied and profits rose. The new small and medium‑sized firms entering the market are reminiscent of construction companies founded by engineers leaving state employment decades earlier. Many founders and executives of these defence firms previously worked in public enterprises, mirroring a pattern seen when former public engineers launched private construction companies after World War II.

This shift has reoriented Turkey’s industrial landscape. Contractors that once specialised in concrete are now investing in precision machining, electronics and composite materials. The workforce has followed suit; thousands of engineers and technicians have retrained from civil to aerospace and mechanical disciplines. In effect, the defence industry has absorbed skills, capital and networks from the construction boom, becoming a new engine of domestic industrialisation.

IDEF 2025: showcase of a transformed industry

The International Defence Industry Fair (IDEF), held in Istanbul from 23 to 26 July 2025, provided a platform for this reoriented sector to display its achievements. More than 900 Turkish firms and 400 foreign companies attended, with delegations from over 100 countriesnextgendefense.com. The fair’s timing — barely a month after the short Israeli‑Iranian conflict — underscored Turkey’s desire to demonstrate its capabilities without appearing reactive.

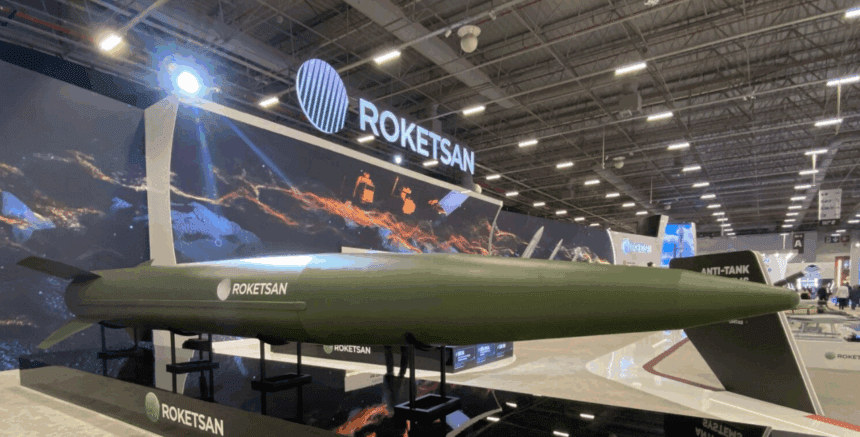

Among the headline products was Tayfun Block‑4, Turkey’s first hypersonic ballistic missile. Developed by state‑owned Roketsan, the missile builds on the Tayfun tested in 2022. Company data indicate that Block‑4 can reach Mach 5 and strike targets between 800 km and 1,000 km away. It carries a multi‑purpose warhead and uses satellite‑guided inertial navigation, with engineers claiming a five‑metre circular error probability. The missile’s debut signalled Turkey’s entry into a small club of countries developing hypersonic systems and offered a striking example of how resources once devoted to concrete are now creating cutting‑edge technology.

DEF 2025 also showcased NEB HAYALET, a domestically developed bunker‑busting bomb. Created by the Ministry of National Defence’s research and development centre, the roughly 2,000‑pound munition is designed to destroy hardened underground targets such as command centres, bunkers and critical infrastructure. In tests it reportedly penetrated over 7 metres of high‑strength C50 reinforced concrete—about five times stronger than concrete used in standard residential buildings—and continued through an additional 1.5 tons of standard concrete. Unlike the 30,000‑pound US GBU‑57 Massive Ordnance Penetrator, which requires deployment from strategic bombers, the NEB HAYALET uses a standard MK‑84 bomb casing; this makes it compatible with widely used NATO aircraft, including Turkey’s F‑16 fighter jets. Defence analysts note that penetrating bombs like NEB HAYALET deter adversaries by threatening protected underground assets and that Turkey’s investment in this capability is part of a broader effort to modernise its arsenal and reduce reliance on foreign suppliers. Development of the munition took more than a decade and has completed qualification under NATO standards. The weapon’s unveiling came shortly after U.S. airstrikes on Iran’s fortified nuclear sites using GBU‑57 bombs, highlighting the relevance of bunker‑busting weapons in contemporary military strategy.

Roketsan also introduced several other systems at IDEF 2025, including a long‑range air‑to‑air missile designed for the upcoming KAAN fighter jet and KIZILELMA unmanned combat aircraft; a 35‑kilogram AI‑enabled munition launched from drones that can strike air or ground targets at distances over 100 km; the IHA‑300, an air‑launched cruise missile for high‑altitude drones and fighter jets with a reach exceeding 500 km; Akata, a submarine‑launched cruise missile intended to hit both land and sea targets; and Şimşek‑2, a two‑stage space launch vehicle capable of delivering payloads up to 1.5 tons into low Earth orbit

Another announcement at IDEF 2025 was the operational activation of the Steel Dome, a domestic networked air‑defence system. Designed to protect Turkey’s airspace from low‑altitude drones to high‑altitude ballistic missiles, the system integrates radars, smart munitions and artificial intelligence. The government has invested heavily in defence electronics firm Aselsan to build production facilities for the system. Such programmes draw on the same project‑management skills and procurement networks that once underpinned mega‑construction projects.

Political and economic implications

The migration of construction capital into defence has influenced Turkish politics. Since the early 2000s, Ankara has pursued a localisation strategy that has increased the share of domestic products in the defence sector to about 80 %. This expansion has created tens of thousands of jobs and fostered a wide ecosystem of contractors and subcontractors. This sustained investment has produced a “new set of political elites” whose influence derives from the novel relationships between civilian authorities, the military and private firms.

Public perceptions are shaped by this convergence of economics and security. Many Turks, even critics of President Recep Tayyip Erdoğan’s social and economic policies, credit him with championing the defence boom. There is also a widely held belief that if he were to lose the next election, momentum in the defence sector could wane. At the same time, private defence companies openly support government policies and benefit from export assistance by Turkey’s embassies. For former construction magnates, this political alignment offers continuity; state contracts and foreign sales were central to their earlier business models and remain so in their new ventures.

Looking ahead

Turkey’s defence‑industrial shift has enabled it to produce advanced systems like hypersonic missiles and integrated air‑defence networks while cultivating a domestic ecosystem that blends state‑run giants with private suppliers. The pivot of construction and real‑estate contractors into arms manufacturing illustrates how economic downturns can redirect capital and talent into new strategic sectors. As the defence industry expands, policymakers will need to manage its economic, political and diplomatic implications, ensuring that the benefits of localisation and export growth are balanced with transparency and fiscal sustainability.