The article titled “Towards a Geopolitics of Carbon Capture & Storage (CCS) in Asia” from the German Institute for International and Security Affairs (SWP) explores the evolving landscape of carbon capture, utilization, and storage (CC(U)S) technology in Asia and its implications for Germany and Europe.

Overview

- CCS Technology: Historically dominated by North America, CCS technology is now being led by key players in Asia, including Saudi Arabia, Japan, China, and others.

- Germany’s Approach: Germany has cautiously approached CCS, but recent developments suggest a need for more proactive engagement.

Regional Dynamics

- China and Gulf States: These countries use CCS to showcase technological strength and support their petroleum sectors. China aims to create technology dependence, while the Gulf States use CCS for enhanced oil recovery.

- Australia, Japan, Korea: These countries are safeguarding their industries against stricter global climate policies and see CCS as a key technology for the future.

Technological Competition

- Patent Leadership: Asian countries, particularly Japan, Korea, and China, are leading in CCS-related patents, displacing Western companies.

- Innovation Areas: Different countries focus on various aspects of CCS technology, with China and Japan having a broad interest, while Korea and Saudi Arabia focus on niche areas.

CCS Hubs and Projects

- Operational Facilities: Japan, China, and the Gulf States have operational CCS facilities, with more projects planned in Australia, Indonesia, and Malaysia.

- Interconnected Regions: Countries like Japan and Korea are forming networks for knowledge transfer and joint projects, while Singapore, Indonesia, and Malaysia are emerging as focal points for CO2 storage.

Industrial and Geopolitical Implications

- Industry Relocation: CCS could influence industrial relocation, with regions offering favorable storage conditions potentially attracting industries.

- Global Climate Action: Strong incentives for emission reduction, such as CO2 taxes, are crucial for the industrial application of CCS.

Recommendations for Europe and Germany

- Climate Diplomacy: Europe needs to adopt a more pragmatic approach to climate diplomacy, focusing on technology partnerships and joint ventures.

- Industrial Policy: Europe should consider strategic investments in CCS technology and establish relevant standards to retain industrial competitiveness.

Conclusion

The document emphasizes the need for Europe and Germany to engage proactively with CCS technology, considering its geopolitical and industrial significance. It suggests that a balanced approach, combining climate action with industrial policy, is essential for maintaining competitiveness in the evolving global landscape of CCS

Read more below.

Towards a Geopolitics of Carbon Capture & Storage (CCS) in Asia

The competition for carbon capture, storage, and utilisation is intensifying. Historically dominated by North America, the lead in this technology is now being seized by key players across Asia – reaching from Saudi Arabia to Japan. Unlike traditional energy (transition) geopolitics, this new arena prioritises technology, geology, and industrial leadership over raw materials. For Germany and Europe, the developments imply a need for more pragmatism in climate diplomacy and policy instruments. Moreover, to keep pace with competitors, policymakers should adopt a proactive approach to CCS vis-à-vis technology and industry.

With the announcement of a German Carbon Management Strategy, carbon capture (utilisation) and storage – collectively known as CC(U)S – has become a significant topic in Germany. The concept encompasses various methods to capture CO2 emissions from combustion processes, such as those in power plants or heavy industry, for subsequent use and/or permanent storage. CCS is closely linked to negative emissions technologies like Direct Air Carbon Capture and Storage (DACCS, often referred to as DAC), which can remove emitted CO2 from the atmosphere. Additionally, CCS provides a pathway to decarbonising the conventional production of hydrogen (often referred to as blue hydrogen).

Germany has approached this technology cautiously; the USA and Canada are still considered global leaders. However, a network of actors in Greater Asia – primarily the Arab Gulf States, Australia, Japan, Korea, Indonesia, Malaysia, and China – are now spearheading these advancements, increasingly driving innovation and collaborative projects.

The region is geopolitically and economically diverse, and the strategic motives for developing CCS differ between countries. For example, China and the Gulf States use CCS to showcase their strength and global influence through innovative infrastructure projects, aiming to impress their constituents and reinforce political power (technopolitics). China furthermore plans to pull other countries into technology dependence, while the Gulf States support their petroleum sectors through CCS: captured CO2 is used in enhanced oil recovery, former petroleum reservoirs serve as CO2 storage sites, and CCS ensures fossil fuel demand in the long term. Other oil and gas producers in the region, such as Malaysia, Indonesia, and Australia, have similar motives. Australia, along with China, Korea and Japan, is safeguarding its industry against the eventuality of stricter global climate policies. Additionally, CCS is considered a potential key technology for this century; technological leadership hence offers both economic and strategic advantages.

Despite these diverse motives, CCS seems to be the common answer across Asia, potentially turning the technology into a new currency of power. The “new energy world” has its own geopolitics – i.e. the interplay between geography and international power – which is already evident, for example, in hydrogen and electricity. In that world, technology, (critical) raw materials, components, infrastructure, and industry (with its associated dependencies) are crucial, as is the ability to set standards. For CCS, CO2 storage capacities and favourable geological conditions are emerging as new power factors, forming the basis of a potential geopolitics of CCS, increasingly centred in Asia.

Given these techno- and geopolitical implications, Germany and Europe must consider how to engage with this technology both domestically and internationally.

Technological competition and the rise of Asia

The CCS sector does typically not require critical raw materials or components; its technology mainly uses common carbon-based materials, metal-organic frameworks, zeolites, silica, and metal oxides. This minimises significant dependencies. (However, high capital costs and substantial energy demands currently impede large-scale deployment.) CO2 is captured either before, during or after combustion. Post-combustion capture, the most common (but energy-intensive) method, removes CO2 from a plant’s flue gas using an amine solution. The chemical, cement, and fertiliser industries already apply it. Pre-combustion capture involves converting coal or gas into a synthetic gas, from which CO2 is then separated. This method is used in power plants and for producing blue hydrogen, but capital cost is high. The oxy-fuel process, which involves burning fuel in pure oxygen, is used in the glass and steel industries and has potential for the cement industry, but it also results in high energy costs.

Asia is becoming increasingly important as a global hub for CCS technological leadership. Between 2010 and 2019, out of the top 15 applicants for relevant patents, only four were Western companies – and Asian competitors have since displaced them from their leading positions. The remaining 11 top applicants included Japanese technology conglomerates, institutions from various sectors in Korea and China, and Saudi Arabia’s national oil company, Aramco – a mix of private and public, profit- and research-oriented organisations. The focus of emerging innovators has also shifted to Asia. While the innovation rate of established Western organisations decreased over the period, their patents remained strong. In terms of patent strength (i.e. the impact, investment, validity, and technical footprint of a patent), Toshiba, Aramco and Mitsubishi dominated during this time, closely followed by General Electric and Alstom. Among emerging innovators, Western entities occupied the top five spots, with a Saudi and a Chinese university following. Korea and China stand out with their number of applications, though not in patent strength.

The areas of innovation also show differences. In Asia overall, the innovation rate in pre-combustion capture is higher. China and Japan are notable for their wide-ranging patent applications, while Korea and Saudi Arabia are making inroads into niche areas: Korea’s applications include pre-combustion and oxy-fuel processes, while Saudi Arabia’s focus includes pre-combustion and methanol production. China’s and Japan’s broad focus reflects a holistic interest in the technology and its applications, while Korea and Saudi Arabia seem driven by their interest in decarbonising the power sector and developing their (already strong) petrochemical industries and clean fuels. These observations indicate an ambivalence of competition and specialisation within Greater Asia.

Interconnected regions: projects and CCS hubs

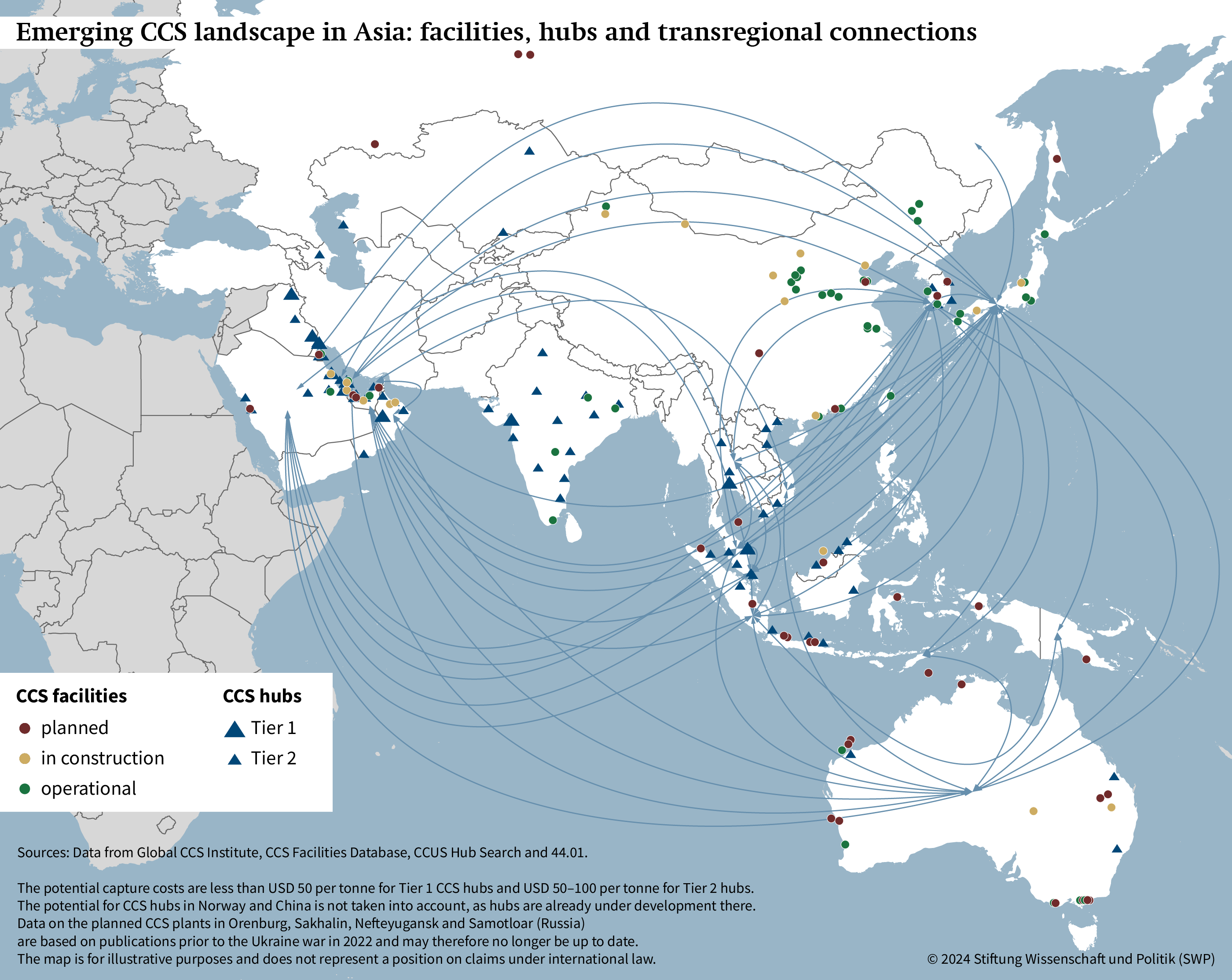

The rising role of CCS in the region is evident on a project level as well (see map). CCS facilities are already operational in Japan, China, and the Gulf States. Australia, Indonesia, and Malaysia are key areas where planning is underway. These countries have implemented, or are in the process of preparing, regulations governing the allocation of CO2 storage capacities to third parties. Like the Gulf States, this group of countries leverages experience in the oil and gas sector, including enhanced oil recovery. Japan and Korea are emerging as research-intensive regions that see CCS as crucial climate action, although Korean facilities are still in the planning stage.

‘CCS hubs’ emerge where industrial clusters are located alongside potential CO2 storage sites and are spread throughout the region (see map). Such hubs show where economies of scale could turn CCS economically viable. The Gulf States’ tremendous potential for decarbonisation stems from their clustered industry and existing hydrogen production as well as the prevalence of former oil wells for storage. Apart from the ASEAN countries offering numerous possible CCS hub locations, India stands out with its vast potential. However, the country currently only has three facilities; recent Indian efforts have gained momentum but remain isolated from the regional context.

A similar situation exists in Russia and Central Asia, where projects are still rare. Prior to the start of the war in Ukraine, Gazprom (Russia) and Mitsui (Japan) had signed a memorandum of understanding for CCS projects in Russia; however, its implementation remains uncertain.

In contrast, China already has a diverse range of projects, particularly in the chemical, iron, steel, and thermal industries. However, regulation is still unclear, and China largely operates autonomously and separately from other Asian countries.

Other key players act in a densely interlinked web (see map). Japan, for example, has initiated a pan-Asian CC(U)S network aiming at knowledge transfer and joint projects. These connections are driven by national interests but are also marked by the abovementioned ambivalence between cooperation and competition. For instance, Japan, Korea, and the Gulf States are linked through blue hydrogen and LNG supply contracts, in addition to collaborative innovation efforts. Similar agreements exist with Australia. Being industrial competitors, Japan and Korea have hardly any projects that link them bilaterally. Singapore, Indonesia and Malaysia have emerged as focal points due to their local usage capabilities and their capacity to import and store CO2 from overseas – particularly from Japan, which lacks sufficient domestic storage capacity.

Industry relocation

As with hydrogen, a central motive of countries using CCS is maintaining their industry, even in the wake of (strong) climate action. Industrial leadership is a core element of new energy geopolitics, making both the provision and use of CCS technologies geopolitically significant. For Europe, CCS could be a double-edged sword. While it offers the potential of retaining industry within Europe, markets with more favourable CCS conditions could one day attract European companies. The interconnectedness of Greater Asia highlights the potential competition for industry relocation – whether this happens, is determined by a series of factors.

Global climate action

A fundamental prerequisite for the industrial application of CCS is strong incentives for emission reduction, such as sufficiently stringent CO2 taxes or cap-and-trade systems. These measures encourage companies to avoid emissions and internalise the costs of their reduction.

Unilateral climate action, however, could lead industries to move their production to regions with less stringent climate regulation – a phenomenon known as carbon leakage. This would cause industry relocation, regardless of whether CCS is available or not. For CCS to be a determining factor in industry relocation requires either homogenous cross-border incentives for CO2 or else carbon border adjustment mechanisms (as proposed by the EU).

CO2 transport

Assuming sufficient incentives exist for emission reduction, the ease of transporting CO2 is a major factor for possible industry relocation. Current plans and existing projects generally prefer pipelines, which are often better in terms of economic efficiency, safety and environmental conservation. However, for smaller transport volumes and longer distances, maritime shipping might be more viable than submarine pipelines.

Pilot projects have shown that CO2 transport is technically feasible, but its economic viability depends on several factors: beside significant incentives for CO2 reduction, these are drastic reductions in transport costs, solid political coordination, and favourable regulation. An amendment to international maritime law permits transporting CO2 across seas but it is yet to be fully ratified.

If CO2 is not going to be transported, CCS could indeed motivate industries to locate in regions with favourable storage capacities and lower energy prices.

By contrast, if CO2 is easily transportable across borders, interregional CO2 markets could emerge. Planned collaborations can serve as examples, such as the one between Japan and Malaysia or Germany’s scheme to send captured CO2 to Norway. Beyond bilateral connections, a multilateral market with a network of emitters and CO2 storers is possible. (The EU is already planning an internal market for captured carbon.) Such a market might be able to retain industries at their current locations in return for paying for the transport and storage of CO2 abroad. (This system is conceptually similar to hydrogen imports, where domestic industry is retained by paying hydrogen exporters.) Germany and Europe have shown interest in carbon transport, since storage options are available but often expensive or politically controversial. The countries of Greater Asia face similar considerations: industrial nations with limited or expensive storage capacity, such as Japan, show a strong interest in CO2 transport.

On the other hand, locations with significant storage potential could benefit in both scenarios: without CO2 transport, they may be able to attract industry from abroad; with CO2 transport, storing foreign CO2 becomes a profitable business model.

However, this would require political and social acceptance in potential storage countries, which cannot be taken for granted. For instance, Oman tends to reject the idea of storing foreign CO2 – not least because some might perceive it as “global waste disposal”.

Storage possibilities

The majority of potential storage sites are depleted oil and gas reservoirs or saline aquifers, such as olivine, serpentine and basalt formations. These formations absorb CO2 well and, depending on the injection and sealing methods used, pose a low risk of leakage.

The gold standard, however, is mineralisation, where injected CO2 chemically reacts with the rock and solidifies, eliminating any risk of future leakage or environmental hazards. By offering a scalable long-term storage solution with environmental co-benefits, mineralisation is particularly relevant for DACCS but for CCS as well. However, it requires specific geological environments: namely mafic rocks (which are found in India, Australia and Russia) or ultramafic rocks, which are more efficient. The latter can be found in the USA and New Caledonia as well as Oman, where initial pilot projects are already underway.

Aside from physical storage capacity – the estimated global storage potential is in the magnitude of teratonnes, far exceeding possible demand – storage is a question of environmental regulation. What environmental risks are acceptable for CCS? Central issues to be determined are the acceptable distance from human settlements and the risk of leakage – site availability decreases with the number of risks to be avoided.

Laxer regulations would increase the number of potential CCS sites, while stricter regulations would limit them and drive up CO2 storage costs. This scarcity would intensify competition for possible CO2 sinks, raising their value: owners would gain an additional scarcity rent, but global utilisation would decrease. This would limit industrial relocation but benefit states with favourable geological conditions. Therefore, even countries with a strong interest in CCS, such as the United Arab Emirates, Oman or Australia, might find pursuing stricter regulation to be the superior strategy.

Conclusions and recommendations

As the first transnational connections form, especially across Greater Asia, the geopolitical landscape of CCS is beginning to unfold. Unlike renewable energy, which relies heavily on critical raw materials, CCS geopolitics focuses on technology and geology. CCS allows oil and gas producers to consolidate their influence by both securing markets and having access to storage sites. While some cross-cutting technologies will likely be contested, there is also a trend towards specialisation, suggesting a more cooperative mode of interaction. However, competition is also emerging, particularly among major emitting industrial hubs. Whether cooperation or competition will dominate might depend on the level of political convergence in the region.

Although climate action is a concern for most countries in the region, socio-economic motives are the dominant drivers for CCS. This pragmatic approach to climate policy could, under certain conditions, make European industry relocate to the region. Consequently, Europe and Germany would face new dependencies in industrial value and supply chains. These prospects reveal the need to rethink some of Europe’s and Germany’s climate policy and industrial policy.

Rethink climate diplomacy

As CCS is integrated into government strategies and industrial value chains, it is also carving out a crucial role in climate diplomacy. Prolonging debates over whether CCS should happen or not is therefore not helpful. While the scope and scale of CCS indeed remain uncertain and require careful consideration, the respective discourse in Europe and Germany is often more dogmatic than anticipatory. Although this discourse names ‘decarbonisation’ as its main objective, it seems to be more concerned with eliminating fossil fuels than reducing emissions pragmatically. Countries in the Global South (and, notably, also the US) increasingly see this anti-fossil agenda as paternalistic, selfish, and Eurocentric, which further erodes Europe’s capacities for climate diplomacy. Moreover, long-term energy scenarios compatible with the Paris Agreement often tacitly rely on CCS or DACCS.

The significant engagement of Greater Asia actors in CCS shows that the region is preparing for a future with pragmatic decarbonisation – one that does not exclude fossil fuels. The commitment to “transition away from fossil fuels” made at the 28th UN Climate Change Conference must therefore be interpreted with nuance. Traditionally, climate action has been a one-way street from the Global North to the Global South. However, CCS has the potential to reverse this flow. Pragmatic climate diplomacy provides Germany and Europe with the opportunity to shape these developments and promote agency abroad.

Specifically, energy and climate partnerships should be complemented by “technology partnerships”. These partnerships should respect the diverse motives and conditions of partner countries instead of attempting to reshape them according to European ideas. A convergence of goals is key, and one-way capacity building should be replaced by technology transfer or joint ventures. Partnerships should increasingly be mini- or multilateral, in line with the CCS landscape, to influence processes effectively. Planning and implementing these measures will require a shift away from solely relying on technoeconomic expertise towards utilising experts on foreign policy and regional studies.

Boldness required: retain industry and establish industrial policy

Without a doubt, Europe’s main risk factor when it comes to potential industry relocation is the currently high energy prices. Easing Europe’s energy crisis is therefore essential – especially for energy-intensive processes like CCS. (Otherwise, CCS costs will need to be directly subsidised.)

However, under certain conditions, CCS could also be a factor in industry relocation. And when industry leaves, it does usually not return, which disrupts complex global supply chains and jeopardises Europe’s role within them, thereby threatening its geopolitical autonomy.

Expanding CCS capacities can help keep the industry within a country and, furthermore, enable blue hydrogen and DACCS. Germany’s cautious-conservative approach to CCS is generally sound, but the country acts rather reactively in international forums. This limits its ability to shape global development within the sector and assert its long-term interests. Europe’s approach to hydrogen regulation, despite criticism, has largely prevailed and might expand the EU’s influence over time. Proactive participation in the international discourse could lay the groundwork for setting relevant CCS standards, such as geological requirements for certification. At a first glance, stricter global standards could be beneficial for Europe, since they reduce the actual global storage potential and thus the incentives for industry relocation. However, this approach carries risks: limiting usable storage capacities could also concentrate them, fostering harmful dependencies and market power. Therefore, more lenient regulations might be preferable.

Europe should acknowledge that CCS technology is increasingly located abroad. Completely abandoning the field would increase Europe’s technological dependency and project costs. Therefore, existing research and development projects should be continued but they will not be sufficient for catching up. A globally tried-and-tested approach – albeit a bold one for Europe – would be to strategically invest in and partner with key companies, which is how China and Saudi Arabia have acted in other critical sectors. This strategy would allow the import of crucial knowledge on CCS technology, diversify economic and political risks associated with the energy transition and enable strategic climate policy.

However, this approach would require a level of government involvement in trade and investment that is unprecedented for Europe. Despite any possible reservations, establishing a European champion in this regard may be worth it. Asia’s rise in CCS and other technologies is largely the result of targeted industrial policy.

This creates a prisoner’s dilemma: market mechanisms alone cannot achieve the same level of coordination as industrial policy, and Europe’s reluctance to adopt the latter means it currently plays with a handicap when competing for these technologies. Beyond recognising that progress in low-carbon technologies is happening outside Europe, bold and new approaches are needed.

By: Dr Dawud Ansari, Dr Jacopo Maria Pepe and Rosa Melissa Gehrung

(English version of SWP‑Aktuell 41/2024)

Source: German Institute for International and Security Affairs (SWP)