Summary by Geopolist | Istanbul Center for Geopolitics:

China faces significant challenges in meeting its growing demand for oil, driven by its rapid economic development and industrialization. As the world’s largest importer of oil, China imports about 10 million barrels per day, mainly from the Middle East, Africa, and Russia. This dependency on foreign oil makes China vulnerable to geopolitical shifts and market volatility.

China has taken several strategic steps to secure its oil supply and mitigate these risks. Firstly, it has established the National Oil Reserve to buffer against supply disruptions. Additionally, China has diversified its oil suppliers, increasing imports from countries like Brazil, the United States, and Norway. This strategy not only reduces reliance on a few sources but also leverages the competitive oil prices in different regions.

Furthermore, China is investing heavily in overseas oil fields and infrastructure projects to ensure stable and long-term access to oil. This includes significant investments in Africa and the Middle East, where Chinese companies are involved in oil extraction and pipeline construction projects. For instance, China has bankrolled the East African Crude Oil Pipeline (EACOP) project in Uganda, portraying itself as a reliable development partner amid Western investors’ retreat due to environmental concerns.

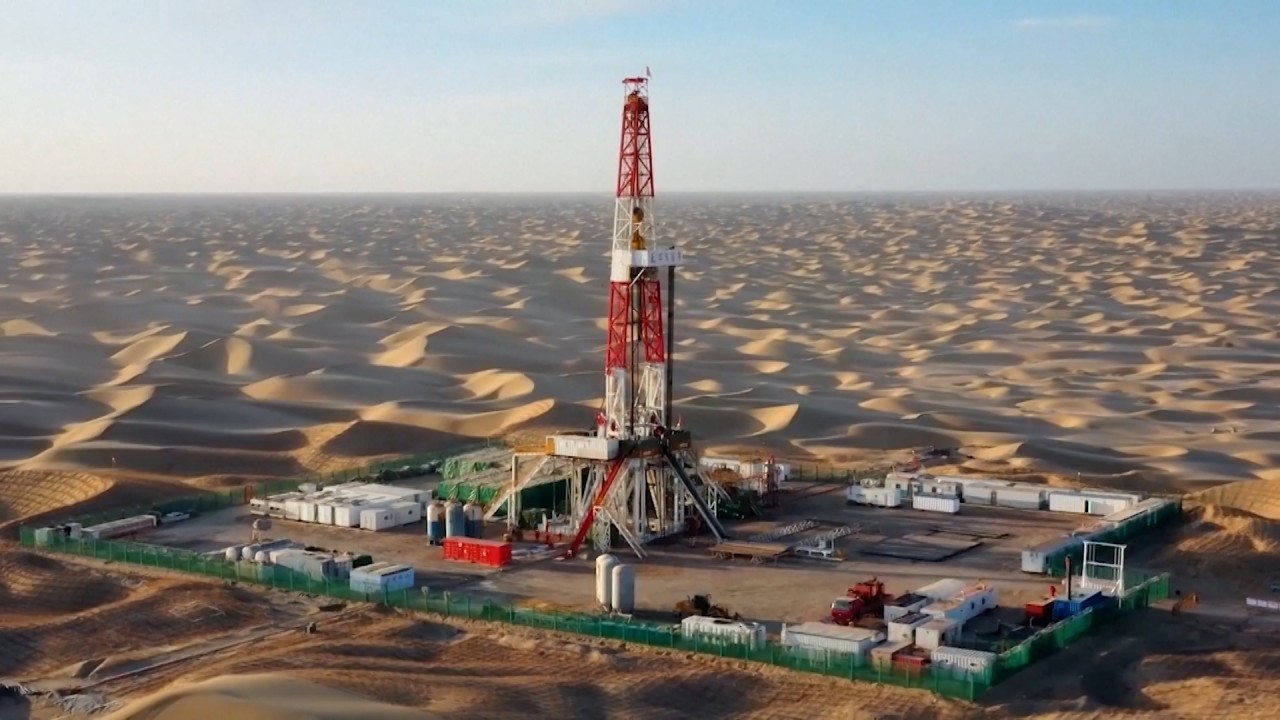

Domestically, China is also pushing for increased production from its oil fields and exploring new technologies to enhance oil recovery rates. However, these efforts are often hampered by the technical challenges of extracting oil from mature fields and the environmental costs associated with increased production.

To address long-term sustainability and energy security, China is accelerating its transition to renewable energy. Investments in solar, wind, and hydroelectric power are expanding, and China is becoming a global leader in renewable energy technology. This shift not only aims to reduce dependency on fossil fuels but also to meet international climate commitments and address domestic pollution issues.

In summary, while China continues to grapple with its high oil demand, it is employing a multi-faceted strategy that includes diversifying suppliers, investing in international projects, enhancing domestic production, and shifting towards renewable energy to ensure its energy security and economic stability.

Read more below.

No easy answers to China’s raging thirst for oil

Since the start of the year, CNOOC has announced two other significant discoveries and each is expected to add over 100 million tonnes of oil equivalent – one in the deepwater Kaiping South oilfield in the Pearl River Delta, near Guangdong province, and the other in the Qinhuangdao oilfield in the Bohai Sea.

These reflect China’s push in recent years to tap more deepwater oil as its onshore oilfields mature and near the end of their productive life. Last year, China produced 208 million tonnes of crude oil – a robust 4.18 million barrels per day (bpd), but still below the 2015 record of 4.3 million bpd.

China remains the world’s largest crude oil importer, taking in 11.3 million bpd last year, a 10 per cent increase over the previous year, according to Chinese customs data. This over-reliance on crude oil imports, mostly from the Middle East, keeps the country’s foreign oil dependency at precarious levels. At the same time, the options to ramp up domestic oil production are limited.

Drilling for oil and gas in ultra-deep waters can cost hundreds of thousands of dollars a day, substantially driving up production costs. In China, such costs sometimes have to be absorbed by the oil companies instead of being passed on to consumers, thus eating into profits. Moreover, during lower global oil price cycles, high production costs are a disincentive for production.

It will not be a surprise that major oil companies prefer cheaper ways to explore for, extract and produce hydrocarbons. At the end of the day, it is also unlikely to be China’s preferred method of oil and gas development.

To help offset these hurdles, China’s energy sector has called for more support from the central government. In March, Ma Yongsheng, chairman of state-run China Petroleum & Chemical Corporation (Sinopec), China’s largest energy company, noted that even though China has abundant shale oil reserves, extraction is more complex than in the US due to geological constraints. The government should boost financial support for research and development for the drilling and extraction of shale resources, he added.

There is simply no easy answer for Chinese government energy planners who need to find ways to increase oil production.

Some analysts are projecting a slowdown in China’s oil demand growth, and that should help alleviate the supply problem. Risk consultancy Eurasia Group says that China is unlikely to return to the pre-Covid-19 model of oil-intensive economic growth, and projects the country’s incremental demand at about 250,000-350,000 bpd of oil this year, less than half of the 2019 growth level.

By: Tim Daiss

Source: South China Morning Post