The article thoroughly examines Donald Trump’s latest proposal to impose one hundred percent tariffs on nations moving away from the dollar. This measure might significantly affect American consumers by doubling the prices of certain items. This strategy is regarded as a protective measure against the increasing trend of de-dollarization, especially given that the BRICS nations, which encompass Brazil, Russia, India, China, South Africa, and several other countries, are seeking to establish an alternative financial system.

The Bretton Woods Agreement of 1944 established the United States dollar as the cornerstone of the international monetary system by linking it to gold. Other currencies were pegged to the dollar, which not only guaranteed the stability of the financial system but also conferred significant power over international trade to the United States. Conversely, this system began to disintegrate in 1971 when President Nixon severed the dollar’s link to gold, leading to an escalation in the United States’ debt. Since that period, the United States has been permitted to issue debt without restriction, contributing to the current national debt of $35 trillion. Economists are apprehensive over the nation’s long-term economic stability due to the significant financial burden of servicing this debt, which exceeds military expenditures.

The article emphasizes that the BRICS nations are leading the de-dollarization effort, having collectively exceeded the G7 in GDP. China has been a leader in the creation of the mBridge project, a blockchain-based network facilitating transactions in multiple currencies without requiring conversion to dollars. The facilitation of direct currency swaps and the diminishment of reliance on the dollar could transform international trade.

There is discourse regarding various alternative financial models, including the creation of a BRICS multicurrency payment network and the potential introduction of a BRICS trading currency backed by gold. The European Currency Unit (ECU) and the “bancor,” developed by economist John Maynard Keynes, exemplify historical frameworks. The bancor proposed a universal unit of account linked to a composite of commodities. These approaches aim to mitigate the disparities caused by the existing dollar-centric system and to stabilize international trade.

Furthermore, the BRICS nations have been accumulating gold reserves, potentially enabling the use of the precious metal to underpin a transformative financial system. The article concludes that, although the journey toward de-dollarization is complex and fraught with potential global consequences, it seems inevitable in light of the evolving economic situation. The increasing influence and dominance of the BRICS nations over natural resources enables them to effectively contest the existing international financial system.

Read the full article below.

BRIC by BRIC, de-dollarization only a matter of time

At a campaign rally in Wisconsin, US presidential candidate Donald Trump stepped up his America First campaign earlier this month by vowing to impose 100% tariffs on goods from any nation that shifts away from the dollar.

Trump did not tell his supporters that the measure to protect the dollar would be painful for American households, with many consumer goods likely to double in price. Around 70% of products sold at Walmart and Target are sourced from China, the nation at the forefront of de-dollarization.

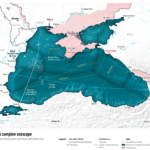

Trump made his announcement on the eve of the highly anticipated annual BRICS summit, scheduled for October 22-24 in Kazan, Russia. Crucially, the meeting may announce a roadmap for developing an alternative to the current dollar-centric global financial system.

Details are still scarce but some observers expect the meeting will announce a multicurrency payment platform. Some BRICS watchers even predict the announcement of a roadmap for a gold-backed BRICS trading currency.

Bretton Woods

The creation of an alternative to the current dollar system would be historic for several reasons. It would mark the first credible attempt to move past the 1944 Bretton Woods Agreement that established the postwar global financial system.

Under Bretton Woods, the dollar was tied to the fixed price of gold while all other currencies were pegged to the dollar. Nations with dollar-denominated trade surpluses could exchange their dollars for gold with the US central bank at the so-called gold window.

The dollar system created financial stability but gave the US near total control over the global financial system. US banks became the clearinghouses for global trade. A Japanese company buying goods from India had to buy dollars to pay its supplier in India. The centralized system enabled the US to ban any person, business or country from the global financial system.

Bretton Woods started to unravel in 1971 when US President Richard Nixon decoupled the dollar from gold. Faced with rising trade deficits, the US chose to close the gold window rather than balance its trade, effectively defaulting on its Bretton Woods obligations.

The decision had major consequences. Freed from the constraints imposed by the gold standard, the US government lost its financial discipline and went on a decades-long spending spree. From 1971 to 2024, the US national debt grew from $400 billion to $35 trillion.

Servicing the national debt has become the biggest line item on the US national budget, even larger than annual defense spending, prompting a growing number of high-profile economists and business leaders to sound the alarm. Tesla CEO Elon Musk recently warned: “At current rates of government spending, America is in the fast lane to bankruptcy.”

More specifically, the US may soon run out of creditors willing to buy its debt. China has sold hundreds of billions in US Treasuries in recent years, and foreign investors have become net sellers of US debt. (The commonly used term “printing money” actually means issuing debt.)

BRICS vs G7

Even without the US incurring its massive debt, gradual de-dollarization is inevitable. The American share of the global economy is declining rapidly.

In 2016, BRICS countries overtook the G7 in combined GDP. The group now accounts for 35% of the world’s output, compared to the G7’s 30%. China alone contributes 30% of global industrial output, nearly double that of the US.

Designing a financial or monetary architecture for countries as diverse as BRICS members is complex but there are several templates. The deputy foreign minister of the Russian Federation, Sergei Ryabkov, called recently for a monetary unit similar to the European Currency Unit (ECU), the precursor to the Euro.

The ECU was conceived in 1979 in response to Nixon’s decision to close the gold window. No longer pegged to gold, the European currency started to fluctuate wildly. The ECU thus created a shared unit of account that stabilized currency markets.

Another template being mentioned is the “bancor,” a currency unit proposed by economist John Maynard Keynes during the Bretton Woods Conference.

Keynes envisioned the bancor as a supranational unit of account, tied to a basket of essential commodities like oil and wheat. This would ensure that the bancor’s value was based on real economic resources rather than fluctuating national currencies.

Keynes also proposed penalties for countries with persistent trade surpluses or deficits, in a bid to encourage balanced global trade. The US rejected the bancor as cumbersome and a hindrance to free trade. But today’s chronic imbalances—particularly the US’s massive trade deficit with China—validate Keynes’s foresight.

An mBridge not too far

While a BRICS common currency is unlikely in the immediate future, China is working with several other countries on mBridge, a blockchain-based platform that accommodates financial transactions in multiple currencies.

Jointly developed by the central banks of China, Thailand, the UAE and Hong Kong, mBridge facilitates instant, peer-to-peer transactions without third-party involvement. The platform reportedly uses blockchain technology similar to cryptocurrency Ethereum and accommodates Central Bank Digital Currencies (CBDC).

The mBridge makes cross-border trade finance more efficient and less costly. A Thai company can sell rice to a Singapore trader in Thai baht or any other agreed-upon currency. Transactions are instant and do not involve third parties. In mBridge, banks of participating countries are the nodes in the network.

BRICS currently comprises nine nations, the original five members of Brazil, Russia, India, China and South Africa plus Egypt, Ethiopia, Iran and the UAE. Over 40 additional countries have expressed interest in joining while some have speculated the grouping could ultimately grow to over 100 countries.

However, BRICS surprised the world by announcing last month that it would temporarily stop accepting new members. No reason was given but the freeze could be related to the complexity and sensitivity of creating a new financial architecture and its potential global impact.

BRICS has plenty of reasons to tread carefully. Even the mere announcement of a future roadmap for a new monetary system could destabilize global financial markets. Obviously, the group will want to avoid accusations of triggering a financial crisis.

The path BRICS takes from here will depend on several factors. How aggressively will the US defend the dollar? How will the US address its growing debt and trade imbalances? What is next for its increasingly dysfunctional political system?

While Trump’s pledge to sanction de-dollarizing nations could be campaign rhetoric, an escalation of America’s sanctions war could trigger a financial reset in response.

BRICS could decide to launch a currency unit partially backed by gold and natural resources like oil, minerals and metals. The group has considerable leverage considering it controls a large and growing part of the world’s natural resources, enough to dictate global prices.

One indication that BRICS is preparing for such a financial reset is its unprecedented hoarding of gold. In the past two years, BRICS members have bought gold at record levels. The monetary metal has historically been used to recalibrate currencies following a financial or monetary crisis.

To be sure, a transformation of the now 80-year-old global financial system is inevitable. Bretton Woods was a neo-colonial makeover of the British Empire that modernized the financial system and moved the seat of power from London to New York.

BRICS, on the other hand, will likely seek to develop a new financial architecture from the ground up, one that reflects the economic and demographic realities of the 21st, not the 20th Century.

Source: Asia Times