Summary by Geopolist | Istanbul Center for Geopolitics:

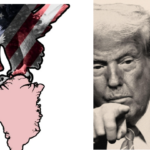

This essay examines the potential risks that may arise as a result of political figures, such as Donald Trump, expressing unfavorable sentiments about the United States currency in public.

Key points:

- The United States maintains substantial economic leverage and financial stability as a result of the dollar’s status as the primary reserve currency worldwide. The use of antagonistic language has the potential to undermine the dollar’s stability, which can have substantial economic repercussions on markets around the world.

- Donald Trump has a history of making statements that are both bold and forceful, and he has done so in direct opposition to the Federal Reserve and the United States economy. It is conceivable that the statements he made could result in financial market volatility and confusion. The essay strongly advises us to carefully consider his concerns regarding the expansion of our power over the Federal Reserve.

- It is conceivable that the negative perception of the United States dollar could potentially erode the confidence of investors and trading partners, leading to significant economic consequences. This may lead to increased inflationary pressures and higher borrowing costs for the United States government and commercial enterprises.

- This article highlights the potential repercussions of political negligence, such as asserting economic claims without supporting evidence. The statement underscores the importance of preserving a stable and predictable economic climate to prevent market volatility that is both unnecessary and disruptive.

- The essay establishes a historical context for Trump’s statements, emphasizing their alignment with broader political and economic trends. This particular event has exposed the fact that populist and nationalist movements worldwide are contributing to an increase in economic uncertainty. The declaration underscores the necessity of effective leadership among all parties to confront these obstacles.

It comprehensively emphasizes the potential consequences of irresponsible disputes concerning the United States currency, emphasizing the substantial harm that it could inflict on the global and U.S. economies. The declaration underscores the importance of political leaders demonstrating caution and responsibility when participating in discussions related to the economy.

Read the full article below.

Why Trump, and others, should be careful in talking down the US dollar

Given this situation, is it wise for US policymakers to weaponise the dollar and the US financial and banking systems for geopolitical purposes? Should they not instead preserve the sanctity of financial contracts and financial markets and protect them from pernicious influences?

The freezing of Russian foreign exchange reserves, for example, was a “bridge too far” in the view of some panellists that “sets in train processes around the world that ultimately could lead to an erosion of the dominant position of the dollar”.

During the past 20 years, the US dollar has declined as a share of global foreign exchange reserves, according to an Atlantic Council paper. This has not benefited any other major currency but rather a group of smaller currencies including the Canadian and Australian dollars and the yuan.

The International Monetary Fund monitors the composition of currencies in global foreign exchange reserves, and its most recent survey shows the share of the US dollar at 58 per cent of total official foreign exchange reserves at the end of the first quarter of 2024, a noticeable fall from 71 per cent in 2000. If gold is included in the reserves, the dollar’s share drops to 48 per cent.

As geopolitical confrontation deepens, the declining share of the US dollar in global reserves is likely to persist. In short, there is no need to talk down the dollar. The conversation is already well-advanced among central banks, markets and investors, and it seems that gold has nowhere to go but up.

By: Anthony Rowley – a veteran journalist specializing in Asian economic and financial affairs

Source: South China Morning Post