The article explores how digital assets, especially those based on blockchain technology, can help developing economies break free from the dominance of the US dollar in international finance. It emphasizes the potential for these economies to increase their economic independence, improve access to financial services, and reduce their reliance on traditional financial systems.

However, the article also highlights the challenges that need to be overcome. These include technological disparities, regulatory issues, and the volatility of digital assets. Despite these obstacles, digital assets present significant opportunities for reshaping the global economic landscape.

Read more below.

Beyond the Dollar: Can Digital Assets Empower Emerging Economies?

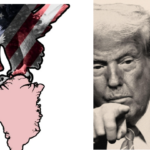

The global economic landscape is on the brink of a monumental shift. The rapid emergence of digital assets, primarily via blockchain-based technologies, presents an unprecedented opportunity for emerging economies to challenge the entrenched dominance of the US dollar. But significant challenges remain.

The conclusion of the Second World War heralded a new era of global economic governance, meticulously crafted in the image of the United States and its Western allies. At the heart of that new order was the establishment of the US dollar as the world’s primary reserve currency.

This system was framed with the creation of pivotal financial institutions such as the World Bank Group and the International Monetary Fund. It established the postwar, neo-liberal economic model. And this structure, reinforced by the economic might and geopolitical influence of the United States, has dominated global finance for more than seven decades.

The advent of computers and the internet propelled globalization to a new level, rocking the postwar system and forcing policy makers and institutions to play catch-up. And now, the digitalization of assets is creating an opportunity for emerging economies to fundamentally recalibrate the global economic scales.

In effect, digital assets represent a transformative shift in the international financial landscape. Principally using blockchain, their decentralized structure and potential for disintermediation are disrupting traditional financial systems in real time.

Indeed, for emerging economies, digital assets are not just a technological innovation but a strategic tool to enhance their economic sovereignty and geopolitical influence. The BRICS+ nations, comprising Brazil, Russia, India, China, South Africa and the recent additions of Egypt, Ethiopia, Iran and the United Arab Emirates, increasingly view digital assets as an opportunity to recast the global order.

That’s because the US dollar still dominates global financial transactions, accounting for approximately 90 percent of them, and is largely managed by Western financial institutions. That dominance grants developed nations, primarily in Europe, North America and parts of Asia, considerable influence over global trade and finance.

For emerging economies, the adoption of alternative currencies backed by digital assets could enhance their control over monetary policy and shield them from the economic fluctuations and policies of the United States.

“Tokenizing,” or converting physical assets such as gold or alternate currencies such as the Indian rupee or the Chinese yuan into digital forms on the blockchain, promises several benefits.

For starters, this could improve efficiency and security, enhance financial inclusion and increase market liquidity. The use of digital forms would potentially simplify transactions, reduce costs and broaden access to financial services.

In addition, the BRICS+ nations could create a common digital tokenized currency for trade settlement, further reducing their reliance on the US dollar. A unified BRICS+ digital currency offers the prospect of streamlining cross-border trade and enhancing economic stability by mitigating the impact of US monetary policy fluctuations. Such a move could give BRICS+ countries greater leverage in the global economic landscape.

Recent initiatives to develop alternative payment systems, such as BRICS Pay, highlight the momentum gathering behind new financial mechanisms independent of the US dollar. BRICS Pay could facilitate transactions using a common central bank digital currency, a form of digital cash issued by sovereign governments.

Additionally, a proposed BRICS stablecoin — a crypto-based digital token backed by stable assets such as fiat currencies (government-issued currency that is not backed by a tangible commodity or precious metals) — offers another viable option for international settlements. Such efforts aim to increase financial autonomy and efficiency for BRICS+ nations in global trade.

In short, the potential for digital assets to accelerate the emergence of new central players in the global economy is immense. And this convergence of strategic interests with the rise of digital assets comes serendipitously at a time when trust in the postwar Bretton Woods financial institutions and the US dollar is at a low point. Though it is unlikely the existing system will be replaced entirely, the geopolitical implications of a more inclusive, multipolar system are profound.

However, many challenges remain. These include unresolved strategic disputes and varying rates of technological development among BRICS+ nations, resistance to change from established interests and the volatile nature of digital assets. Additionally, regulatory and cybersecurity issues must be addressed.

That said, the potential rewards appear too great to ignore. For emerging economies, investing in blockchain technology, fostering innovation and collaborating to develop a digital financial ecosystem are strategic necessities. Such moves could enable these countries to reshape the global financial landscape, establishing standards that enhance their autonomy and influence.

The emergence of digital assets heralds a potentially groundbreaking shift in the global economic order, offering emerging economies a powerful lever to challenge the status quo. By embracing digital currencies, these nations can enhance their economic sovereignty, reduce their dependency on the US dollar and foster a more egalitarian global economy.

Source: Centre for International Governance Innovation (CIGI)